Category: Uncategorized

Welcome to the world of Rrevenue Operations, where every decision we make is driven by data and results. The goal of revenue operations is to align marketing, sales, and customer success teams to drive revenue growth and increase customer satisfaction. But how do we know if our revenue operations efforts are working effectively?

In this article, I will guide you through the key metrics and strategies for measuring the effectiveness of Revenue Operations.

Key metrics for measuring Revenue Operations

To evaluate the overall effectiveness of your revenue operations, several key metrics can provide valuable insights. Let’s take a closer look at each one:

- Marketing Qualified Leads (MQLs): The number of leads that meet your marketing team’s criteria and have the potential to become customers. By tracking MQLs, you can assess the effectiveness of your marketing campaigns and lead-generation efforts.

- Sales Qualified Leads (SQLs): The percentage of MQLs that meet your sales team’s criteria and are deemed ready for the sales process. Tracking SQLs helps you understand the quality of leads passed on by marketing and the effectiveness of your lead scoring.

- Conversion Rate: This metric measures the percentage of SQLs that convert into paying customers. It provides insights into the effectiveness of your sales process and the alignment between marketing and sales teams.

- Customer Lifetime Value (CLTV): CLTV measures the total revenue generated from a customer over the course of their relationship with your company. Tracking CLTV helps you understand the value of your customers and the success of your customer retention and upsell strategies.

- Churn Rate: Churn rate measures the percentage of customers who cancel or stop using your product or service. By monitoring churn rate, you can identify areas of improvement in your customer success efforts and ensure long-term customer satisfaction.

Now that we have explored the key metrics for measuring revenue operations, let’s delve into some additional details to enhance your understanding:

Marketing Qualified Leads (MQLs): Tracking MQLs not only helps you assess the effectiveness of your marketing campaigns and lead generation efforts, but it also enables you to identify trends and patterns in your target audience’s behavior. By analyzing the characteristics and demographics of your MQLs, you can refine your marketing strategies and tailor your messaging to attract more qualified leads.

Sales Qualified Leads (SQLs): While tracking SQLs provides insights into the quality of leads passed on by marketing and the effectiveness of your lead scoring, it is also crucial to analyze the reasons behind disqualifications. Understanding why certain leads do not meet the criteria can help you optimize your lead qualification process and bridge any gaps between marketing and sales. Additionally, by closely monitoring the conversion rate of SQLs, you can identify potential bottlenecks in your sales process and implement targeted improvements to increase conversion rates.

Customer Lifetime Value (CLTV): While CLTV measures the total revenue generated from a customer over their relationship with your company, it is essential to consider the different touchpoints and interactions that contribute to this value. By analyzing the customer journey and identifying key moments of value creation, you can optimize your customer retention and upsell strategies. This includes providing exceptional customer experiences, personalized communication, and proactive support to maximize the lifetime value of each customer.

Churn Rate: Monitoring churn rate is not only about identifying customers who cancel or stop using your product or service but also understanding the underlying reasons behind their decision. By conducting thorough churn analysis, you can uncover valuable insights into customer satisfaction, product usability, and competitive landscape. Armed with this knowledge, you can make data-driven decisions to reduce churn, improve customer success efforts, and enhance overall customer satisfaction.

Measuring revenue acquisition and growth

One of the primary goals of revenue operations is to drive revenue growth through effective acquisition strategies. Here are a few metrics to help you measure your revenue acquisition efforts:

- Customer Acquisition Cost (CAC): CAC is the average cost of acquiring a new customer. It includes expenses related to marketing, sales, and customer success efforts. By comparing CAC to CLTV, you can determine the efficiency of your acquisition strategies.

- Return on Investment (ROI): ROI measures the profitability of your revenue operations efforts. It calculates the return on each dollar invested in sales and marketing. Tracking ROI allows you to identify the most effective channels and campaigns.

- Lead Response Time: How quickly your sales team responds to leads can significantly impact conversion rates. Measure the average lead response time to ensure you’re capitalizing on every potential opportunity.

Now, let’s delve deeper into each of these metrics to gain a comprehensive understanding of how they contribute to revenue acquisition and growth.

Customer Acquisition Cost (CAC)

The Customer Acquisition Cost (CAC) metric is a crucial indicator of how much it costs your business to acquire a new customer. It takes into account various expenses, such as marketing campaigns, sales efforts, and customer success initiatives. By calculating the CAC, you can evaluate the effectiveness and efficiency of your acquisition strategies.

For example, if your CAC is significantly higher than the Customer Lifetime Value (CLTV), it may indicate that your acquisition costs are too high compared to the potential revenue generated from each customer. This insight can help you optimize your marketing and sales processes to reduce costs and improve profitability.

Return on Investment (ROI)

Return on Investment (ROI) is a metric that measures the profitability of your revenue operations efforts. It quantifies the return you receive for each dollar invested in sales and marketing activities. By tracking ROI, you can identify the most effective channels and campaigns that generate the highest returns.

For instance, if you find that a particular marketing campaign has a high ROI, it signifies that the investment made in that campaign has resulted in a significant increase in revenue. This information enables you to allocate your resources more efficiently, focusing on the strategies that yield the best returns on your investments.

Lead Response Time

The lead response time metric measures how quickly your sales team responds to leads generated through various marketing channels. It plays a crucial role in determining conversion rates and the overall success of your revenue acquisition efforts.

Research has shown that the faster you respond to leads, the higher the chances of converting them into paying customers. By measuring the average lead response time, you can identify any bottlenecks or delays in your sales process that may be hindering your revenue growth. This insight allows you to implement strategies to improve response times and capitalize on every potential opportunity.

Measuring Sales Pipeline and Process

Understanding the health and efficiency of your sales pipeline is crucial for revenue operations success. By effectively measuring your sales pipeline and process, you can gain valuable insights that will help drive your business forward. Let’s dive deeper into some key metrics that can provide you with a comprehensive understanding of your sales performance:

- Opportunity Win Rate: The percentage of opportunities that successfully close. This metric is a powerful indicator of your sales team’s ability to convert leads into paying customers. By tracking win rates, you can identify bottlenecks in your sales process and provide targeted training and support to improve conversion rates. For example, if you notice a low win rate, it may indicate that your sales team needs additional training on objection handling or negotiation skills.

- Time to Close: How long it takes to convert a lead into a paying customer. Monitoring the time it takes for deals to close is essential for optimizing your sales process. By analyzing this metric, you can identify areas of improvement and implement strategies to accelerate conversions. For instance, if you notice that deals are taking longer to close than expected, you may want to evaluate your sales cycle and identify potential roadblocks that are causing delays.

- Deal Size: The average value of your closed deals. Tracking deal size is crucial for understanding the effectiveness of your sales efforts. It helps you identify whether your sales team is targeting the right customers and closing deals that align with your revenue goals. By analyzing this metric, you can determine if you need to adjust your sales strategy to focus on higher-value opportunities or if there are opportunities to upsell or cross-sell to existing customers.

Measuring these key metrics will provide you with a comprehensive view of your sales pipeline and process. However, it’s important to remember that these metrics should not be viewed in isolation. They are interconnected and should be analyzed collectively to gain a holistic understanding of your sales performance. By regularly monitoring and analyzing these metrics, you can make data-driven decisions that will drive your sales team’s success and ultimately contribute to the growth of your business.

Measuring Sales Velocity and Pipeline Velocity

Sales velocity and pipeline velocity are crucial metrics for assessing the effectiveness of your revenue operations. Sales velocity measures how quickly opportunities move through your sales pipeline, while pipeline velocity measures the overall speed of your pipeline. These metrics provide valuable insights into the efficiency of your sales process and can help you identify areas for improvement.

Let’s take a closer look at how to measure sales velocity. Sales velocity is calculated by multiplying the number of opportunities in your pipeline by your win rate and average deal size, divided by your average sales cycle time. This formula allows you to determine how quickly you are converting opportunities into closed deals and generating revenue. By tracking sales velocity over time, you can identify trends and patterns that can help you optimize your sales process. For example, if you notice a decline in sales velocity, it may indicate that your sales cycle is becoming longer or that your win rate is decreasing. Armed with this information, you can take proactive steps to address these issues and improve your sales performance.

Now, let’s delve into pipeline velocity. Pipeline velocity is calculated by dividing the total value of opportunities in your pipeline by the average time it takes for an opportunity to move through each stage. This metric provides a holistic view of the efficiency of your sales pipeline and helps you identify bottlenecks or areas where deals tend to get stuck. By measuring pipeline velocity, you can pinpoint specific stages in your sales process that may require attention. For instance, if you notice that opportunities tend to linger in the negotiation stage for an extended period, it may indicate a need for more streamlined communication or improved objection handling. By addressing these challenges, you can accelerate the movement of opportunities through your pipeline and increase your chances of closing deals.

By regularly monitoring and analyzing both sales velocity and pipeline velocity, you can gain valuable insights into the effectiveness of your revenue operations. These metrics serve as powerful indicators of your sales team’s performance and can guide your decision-making process. Remember, the key to success lies in continuously optimizing your sales process based on these metrics, driving efficiency, and ultimately boosting your revenue.

Measure your entire GTM with Growblocks

Now that you know how to measure the effectiveness of Revenue Operations, let’s put that to action across your bowtie.

Growblocks is here to revolutionize the way you approach Revenue Planning, Forecasting, and Monitoring. Our platform empowers RevOps and CROs to pinpoint issues in their GTM engine swiftly and accurately.

With Growblocks, you can build a robust plan, set precise expectations for every metric, and utilize real-time data to forecast performance.

Stay ahead of the curve by monitoring your progress and catching problems before they escalate. Learn more about how Growblocks can transform your revenue operations today.

Top 15 RevOps KPIs and how to measure them

As RevOps, getting lost in a sea of Metrics and KPIs is incredibly easy- especially when you’re throwing around acronyms left, right, and center.

CAC, NRR, CVR, CAC…

But each one is crucial it is to measure the success of your sales and Go-To-Market. They’re the bread and butter of RevOps, and you’re going to need them in your arsenal, and you monitor every aspect of your SaaS bowtie.

That means tracking the right KPIs is vital for growth and predictability.

In this article, we will go through 15 KPIs you should focus on, explain what each means, and give you examples of how to measure them.

1. Customer Acquisition Cost (CAC)

It shouldn’t be a surprise that understanding how much it costs to acquire each new customer would be on top of this list.

To calculate your CAC, divide your sales and marketing expenses for a given period by the number of new customers acquired during that time.

For example, if you spent $10,000 on sales and marketing and acquired 100 customers, your CAC would be $100.

Tracking this metric isn’t just about determining the financial investment required to acquire customers; it also provides direct feedback to your GTM strategy.

By analyzing your CAC, you can identify areas where you may be overspending or underperforming, allowing you to make data-driven decisions to optimize your customer acquisition process.

Understanding your CAC can help you set realistic goals and expectations for your business. By knowing how much it costs to acquire a customer, you can establish a benchmark for your marketing budget and allocate resources accordingly. This knowledge enables you to make informed decisions about scaling your business, launching new campaigns, or exploring different customer acquisition channels.

With that said, watching just your CAC does have its disadvantages.

2. CAC Payback

While CAC is a great starting point, it does come with its share of drawbacks.

That’s why we recommend you look at your. CAC Payback, also known as your break-even point.

Essential, CAC:PB is the time it takes the company to recoup its spending. Intuitively, the shorter the Payback period – the better the business is doing.

Since revenues are realized over the duration of the subscription, it’s vital to know how long it takes for these revenues to cover the initial costs of acquiring customers. This helps in assessing the viability of the company’s marketing strategies and the overall health of its business model.

3. Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) helps you understand the long-term value of your customers. It’s the predicted net profit that a customer is expected to generate throughout their entire relationship with your company.

To calculate CLTV, you need to consider three key factors: Average Revenue Per Account (ARPA), Gross Margin and Churn Rate.

- ARPA (Average Revenue Per Account): This is the average monthly revenue generated from each customer account. In a SaaS business, this would typically be the monthly or annual subscription fee multiplied by the number of months or years.

- Gross Margin: This is the percentage of revenue that remains after the cost of goods sold (COGS) is deducted. The gross margin is expressed as a percentage and represents the profitability of the company before operating expenses, interest, and taxes.

- Churn Rate: This is the rate at which customers cancel their subscriptions. It’s a critical factor in the SaaS business model, as high churn rates can significantly reduce CLTV. The churn rate is expressed as a percentage of customers who leave over a certain period.

Let’s take a look at an example. Let’s say your company has an ARPA of $500, a gross margin of 70%, and a monthly churn rate of 2%.

This means that, on average, each customer is expected to generate $17,500 in net profit throughout their entire relationship with your company. The bigger the number, the better.

One thing to keep in mind when it comes to CLTV, this is always a point-in-time calculation. This means it’ll change month to month, depending on the performance of your business.

4. Sales Cycle Length

The sales cycle length measures the average time it takes from the initial contact with a prospect to closing the deal. By tracking this metric, you can identify bottlenecks in your sales process and optimize it for faster conversions.

Long story short: Aim to reduce your sales cycle length without compromising the quality of your deals.

There are plenty of reasons for a longer/short sales cycle. For example:

The complexity of your product/service: If your offering requires a longer decision-making process or involves multiple stakeholders, it is natural for the sales cycle to be longer. By streamlining your sales process and providing clear and concise information to your prospects, you can expedite the decision-making process and reduce the sales cycle length.

Quality of Leads: Not all leads are created equal, and investing time and effort in pursuing low-quality leads can unnecessarily prolong your sales cycle. By focusing on lead qualification and targeting prospects who are more likely to convert, you can shorten the sales cycle and improve your overall sales efficiency.

Sales Enablement: It’s essential to provide your sales team with the necessary tools and resources to navigate the sales cycle effectively. Equipping them with comprehensive product knowledge, effective sales scripts, and efficient CRM systems can streamline the entire process, enabling your team to close deals more efficiently and reduce the sales cycle length.

By understanding the factors that influence the sales cycle length and implementing strategies to optimize it, you can accelerate your sales conversions and drive business growth.

5. Sales Pipeline Velocity

Sales pipeline velocity measures the speed at which prospects progress through your sales pipeline, moving from one stage to the next.

To calculate it, you simply divide the total value of closed-won deals by the time it took to close them.

For example, let’s say you have:

- 100 opportunities in the pipeline,

- An average deal value of $5,000.

- A win rate of 25% (meaning 25% of opportunities are successfully converted into sales),

- And an average sales cycle length of 60 days

That would look like this:

This result means the company’s sales pipeline generates approximately $20,833.33 in revenue per day, given the current opportunities, deal value, win rate, and sales cycle length.

A high velocity indicates that your sales process is streamlined, prospects are progressing smoothly, and deals are closing quickly.

On the other hand, a low velocity may indicate potential issues that need to be addressed, such as lengthy sales cycles or a lack of qualified leads.

6. Conversion Rate

When we talk about conversion rate, we usually mean the metric that measures the percentage of leads that convert into paying customers.

To calculate it, divide the number of customers by the total number of leads and multiply by 100. For instance, if you have 500 leads and 100 of them become customers, your conversion rate would be (100 / 500) x 100 = 20%.

7. Annual Recurring Revenue (ARR)

ARR is the projected annual revenue generated from your recurring subscriptions. To calculate this KPI, multiply the average monthly recurring revenue (MRR) by 12. For example, if your MRR is $10,000, your ARR would be $10,000 x 12 = $120,000. Keep an eye on your ARR to gauge the stability and growth potential of your SaaS business.

8. Monthly Recurring Revenue (MRR)

MRR represents the sum of your recurring monthly subscription fees. It’s a critical metric for SaaS companies as it provides a clear picture of your monthly revenue. Track your MRR to identify trends, measure growth, and make informed decisions to drive your business forward.

9. Average Contract Value (ACV)

ACV refers to the average value of your contracts with customers. To find your ACV, divide your total contract value by the total number of contracts. For example, if you have 50 contracts worth a total of $100,000, your ACV would be $100,000 / 50 = $2,000.

10. Revenue Growth Rate

Revenue growth rate measures the percentage increase in your revenue over a specific period. To calculate this KPI, subtract your previous period’s revenue from your current period’s revenue, divide by your previous period’s revenue, and multiply by 100.

For instance, if you had $100,000 in revenue last month and $150,000 this month, your growth rate would be (($150,000 – $100,000) / $100,000) x 100 = 50%.

11. Net Promoter Score (NPS)

NPS measures customer loyalty and satisfaction. It’s calculated by asking customers to rate, on a scale of 0-10, how likely they are to recommend your product or service to others.

Divide your respondents into three categories: promoters (9-10), passives (7-8), and detractors (0-6). Subtract the percentage of detractors from the percentage of promoters to determine your NPS.

Aim for a high score, as it shows your customers are happy and willing to promote your brand.

For context, the average NPS score for B2B SaaS is somewhere between 31-50.

Keep in mind that as a metric, NPS scores aren’t always perfect and do come with some drawbacks. So make sure not to over-rely on it when you can.

12. Customer satisfaction score (CSAT)

In Case NPS isn’t enough, CSAT is another vital metric to assess customer satisfaction and loyalty. It asks customers to rate their satisfaction with a specific product, feature, or interaction on a scale.

Track your CSAT regularly and take necessary actions to improve customer experience and happiness.

13. Net Revenue Retention (NRR)

NRR measures your ability to retain and expand revenue from existing customers. To calculate NRR, sum up the revenue from existing customers at the beginning of a period, add expansion revenue, and subtract any revenue lost due to churn. Divide the resulting figure by the original revenue from existing customers, and multiply by 100. A positive NRR above 100% indicates successful revenue retention and expansion.

14. Renewal Rate

Your renewal rate indicates the percentage of customers who renew their subscriptions at the end of their contract term. High renewal rates demonstrate customer satisfaction and loyalty. To calculate your renewal rate, divide the number of renewals by the number of eligible contracts and multiply by 100. Strive to maintain a healthy renewal rate to ensure a sustainable revenue stream.

Keeping track of these RevOps KPIs is crucial for optimizing your sales and marketing strategies, scaling your business, and keeping your customers happy. Remember, these metrics can vary from company to company, so adapt them to your specific needs and goals.

15. Net Dollar Retention (NDR)

Net Dollar Retention (NDR) in B2B SaaS is a key metric that measures the revenue retained from existing customers over a specific period, factoring in upgrades, downgrades, and churn. It’s a crucial indicator of customer satisfaction and the company’s ability to grow revenue from its current customer base.

Where:

- Starting MRR is the Monthly Recurring Revenue at the start of the period.

- Expansion is the additional revenue from upsells or cross-sells to existing customers.

- Contraction is the lost revenue from downgrades by existing customers.

- Churn is the revenue lost from customers who cancel their subscription.

The result is expressed as a percentage. An NDR greater than 100% indicates that revenue growth from existing customers exceeds the losses from churn and downgrades, which is a positive sign of business health in B2B SaaS.

Here’s an example of what that looks like.

Say you’re looking at:

Starting Monthly Recurring Revenue (MRR) at the start of the period: $10,000

Additional revenue from upsells or cross-sells to existing customers (Expansion): $2,000

Lost revenue from downgrades by existing customers (Contraction): $500

Revenue lost from customers who cancel their subscription (Churn): $1,000

The Net Dollar Retention (NDR) would be 105%. This means that, after accounting for upsells, downgrades, and churn, the company has retained 105% of its starting revenue from existing customers, indicating revenue growth from the existing customer base.

Track every KPI with Growblocks.

Now that you’re equipped with the knowledge of some of the key RevOps KPIs, it’s time to put that knowledge into action.

Growblocks is the Revenue Operations platform designed to help RevOps and CROs calculate, track and monitor every important KPI and metric within your revenue engine. With our innovative GTM Data modeling, you can do GTM Planning, Forecasting, and Monitoring like never before. Discover issues in your GTM engine with a single click, build robust plans, and let Growblocks provide real-time expectations for every metric.

Ready to transform your GTM engine? Learn more about how Growblocks can drive your revenue growth.

How Superside run their GTM at +$50M ARR

Do you ever feel like the weekly GTM meetings are suboptimal? You’re unable to get to the heart of problems in the session? There’s disagreement about what KPIs matter – and everyone has their own reports?

You’re not alone.

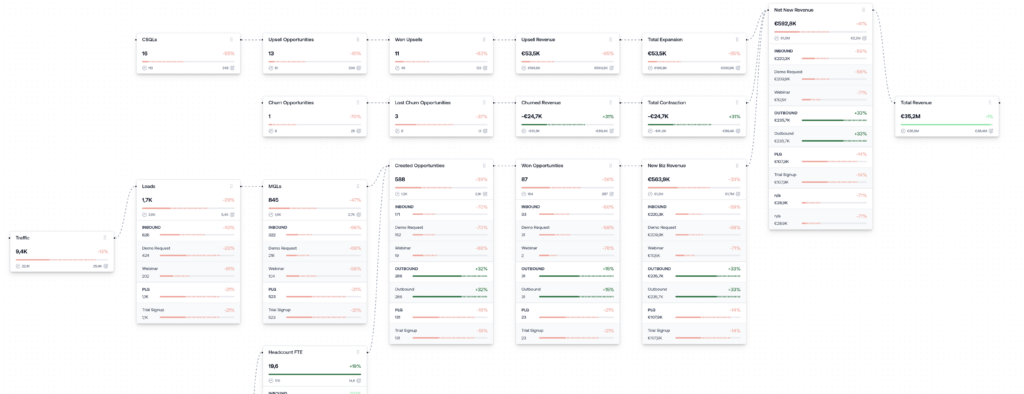

Superside wanted to see the full bowtie to identify issues and opportunities.

Before Growblocks, the team spent lots of time preparing presentations for weekly GTM leadership meetings – and often had to follow up with ad hoc research to answer questions coming from the meeting.

“All the things people are saying about the SaaS bowtie, you now have it visualized and you have all the KPIs on one page. Suddenly you can easily identify trends and issues in your pipeline, or what works and what doesn’t work.”

Andreas Drakos, Director of RevOps

Superside

While the team had a hunch about ongoing problems, validating them required lots of custom analysis and took days. Ultimately, it was an inefficient way to run the operating cadence.

Running the GTM

Every week, GTM leaders along with RevOps run through all KPIs to understand how they’re tracking against the month and what happened last week.

“We were just presenting data every week that we were calculating, exporting to Google Sheets and presenting.“

While RevOps is expected to present during the meeting, the team often switches to Growblocks during the session.

“Growblocks has completely changed the way we’re doing these meetings and the discussions that are happening.”

When Andreas and his team gets a question, they no longer have to reply “oh yes, we’ll need to do some reports and get back to you”, the answer becomes: “let me switch to Growblocks and show you exactly what is happening”.

This lets the team identify problems and start articulating solutions faster.

“So we unraveled a quite significant issue”. Superside discovered that a specific segment of pipeline was underperforming. The problem was not the conversion rate from marketing. It was the win rate down the line. “We had a hunch about it, but with Growblocks it was obvious.”

With that initial finding, Superside went through closed lost opportunities to identify the loss reasons. They ran a small survey with some of their customers along with other actions to understand why the segment wasn’t performing.

“And then we realized, we don’t have an appealing offer and messaging for this segment”

As a result, the team completely changed the communication, messaging and offering specifically targeting this segment, seeking to increase their winrates. This is just one of many challenges and opportunities discovered.

Three core benefits

Superside is able to gain three clear benefits for operating their GTM with Growblocks.

1. Full funnel visibility

Superside is able to see their entire bowtie and run advanced diagnostics in no time. This enables them to answer questions and arrive at important business decisions at unprecedented speed.

“The first time that I saw that I went, okay in order for me to build this I need three more people in my team full-time.”

2. Streamline definitions

Before, the team weren’t fully aligned on KPI definitions – and they were able to produce their own reports to contest any challenges presented with data. With Growblocks, they’ve been able to streamline definitions and end data objections.

“It helped us streamline internal definitions across marketing, sales and customer success – it helped us explain to marketing, I don’t care how many inbound call bookings you’re generating if those don’t convert down the line. Sales, I don’t care how many companies you’re booking if they are not renewing”.

3. Better GTM meetings

Previously, RevOps was simply presenting data during GTM meetings. Now the team is able to trigger important business conversations about underperformance or opportunities.

It makes it clear how actions in one part of the bowtie impacts another – enabling them to build a durable and efficient business.

Working with Growblocks

Having worked with several software vendors, Andreas was impressed by the approach taken to get Superside up and running and reaching an impact.

“Growblocks booked the meetings. They communicated a clear timeline, ran a discovery meeting just to understand our go-to-market strategy and then they came back with a solution proposal. That’s a better approach than ‘this is the tool, try to figure out how to use it’”

Superside was up and running within 4 weeks and followed a clear implementation plan set forward by Growblocks. “The project management, the communication and the transparency during the onboarding and the effort that Growblocks did is definitely a winning argument.”

Currently, Growblocks run weekly check-ins to support Superside in continuing to maximize the utility of the platform.

About Superside

Superside is the leading Creative as a Service solution. They offer a unique combination of the world’s best creatives, a frictionless platform, and a flexible subscription model that extends the creative skills, perspectives, and capacity of in-house creative teams. Superside supports more than 450 ambitious brands, from giants like Amazon, Google, and Meta to fast-growing companies like 6Sense, Snowflake, and Grammarly.

RevOps Best Practices in 2024

Welcome to 2024, where Revenue Operations (RevOps) has emerged as a critical function for driving growth and aligning sales, marketing, and customer success teams. In this article, we’ll explore some of our favorite RevOps best practices that will help your organization thrive in the ever-changing business landscape. So, buckle up and let’s dive in!

The Evolution of the RevOps role in your organization

RevOps has come a long way since its inception. It has transformed from a tactical function to a strategic powerhouse. Nowadays, companies realize that RevOps is not just about crunching numbers and managing pipelines; it’s now a key role in revenue growth and improving the customer experience. So much that it became one of the fastests growing jobs in 2023.

In this new era, RevOps professionals are expected to be the bridge between different departments. They need to understand the goals and challenges of each team and align them towards a common objective. So, if you’re looking to embrace RevOps in your organization, it’s essential to understand its evolution and the value it brings.

Let’s delve deeper into the evolution of the RevOps role and how it has shaped the success of organizations.

Initially, the role was primarily focused on streamlining sales operations and ensuring accurate revenue reporting. However, as businesses realized the potential of a more integrated approach, they began to expand their scope.

With the rise of data-driven decision-making, RevOps professionals started leveraging analytics and technology to gain insights into customer behavior and optimize revenue generation. They began collaborating with marketing teams to align messaging and campaigns with sales objectives, ensuring a seamless customer journey from lead generation to conversion.

Furthermore, as customer expectations evolved, RevOps professionals took on the responsibility of enhancing the overall customer experience. They worked closely with customer success teams to identify pain points and implement strategies to improve retention and upselling opportunities. By analyzing customer feedback and data, RevOps professionals were able to identify areas of improvement and implement changes that directly impacted revenue growth.

Today, the role has become even more critical in organizations. With the increasing complexity of sales and marketing processes, RevOps professionals act as the central hub, connecting all the moving parts. They collaborate with sales, marketing, and customer success teams to ensure alignment, streamline processes, and drive revenue growth.

The evolution of the RevOps role has been transformative for organizations. From a tactical function to a strategic powerhouse, RevOps professionals now play a crucial role in driving revenue growth and improving the customer experience. By understanding the evolution and value of RevOps, organizations can embrace this approach and unlock its full potential.

Build the right RevOps team

RevOps is a team sport, and like any team, it’s crucial to have the right players. When building your RevOps team, look for individuals who are not only data-savvy but also possess excellent communication and collaboration skills. You need people who can translate numbers into actionable insights and bring different teams together.

But what exactly does it mean to assemble the Avengers of revenue growth?

First, you need a RevOps leader that can see beyond the dashboard. A Go-to-Market expert that understands your motions knows which situation makes more sense to execute on, as well as understanding your persona and ICP and what unit economic limitations you’re working with.

Whether it’s a one-person operation or a team, they should have a deep understanding of the entire customer journey. From lead generation to customer retention, they should be well-versed in every stage of the revenue cycle. This holistic perspective allows them to identify bottlenecks, optimize processes, and drive revenue growth at every touchpoint.

Additionally, your RevOps team should be equipped with a diverse skill set. While data analysis is undoubtedly a core competency, it’s equally important to have team members who excel in strategic thinking, project management, and problem-solving. This multidimensional approach ensures that your team can tackle complex challenges from different angles, leading to innovative solutions and sustainable growth.

Furthermore, a successful RevOps team is one that fosters a culture of collaboration and cross-functional alignment. They should act as the glue that brings together marketing, sales, and customer success teams, breaking down silos and fostering a unified revenue strategy. By promoting open communication and knowledge sharing, your RevOps team can create a seamless and efficient revenue engine that drives success for the entire organization.

So, when building your RevOps team, remember to seek out individuals with a comprehensive understanding of the customer journey, a diverse skill set, and a collaborative mindset. By assembling the Avengers of revenue growth, you’ll be well on your way to achieving your revenue goals and propelling your organization to new heights.

Implementing Data-Driven Decision Making

Data is the fuel that powers RevOps. It gives you insights into your customer behavior, sales performance, and market trends. But collecting data is not enough; you need to make sense of it. Implementing data-driven decision making is crucial to identify patterns, uncover opportunities, and optimize your revenue-generating processes.

So, don’t just rely on your gut feeling when making important business decisions. Let data be your co-pilot and lead the way!

Imagine this scenario: you’re a sales manager trying to determine the best pricing strategy for your products. Without data, you might rely on intuition or guesswork to set the prices. However, by implementing data-driven decision making, you can analyze historical sales data, customer preferences, and market trends to identify the optimal price points that maximize revenue and customer satisfaction.

Furthermore, data-driven decision making can help you identify hidden opportunities that you may have overlooked otherwise. By analyzing customer data, you may discover untapped market segments or potential upselling opportunities. Armed with this information, you can tailor your marketing strategies and sales approaches to target these specific segments, ultimately boosting your revenue and market share.

Creating a Customer-Centric Strategy

Forget the old ways of Growth at all Costs (GaaC). Today SaaS should be predominantly in the era of customer experience.

Understand their pain points, preferences, and desires. Tailor your messaging, sales processes, and marketing campaigns around their needs.

Happy customers lead to loyal customers, and loyal customers are the lifeblood of successful growing organizations.

When it comes to creating a customer-centric strategy, it’s important to go beyond just understanding your customers’ needs. You need to delve deeper into their motivations and aspirations. What are their long-term goals? What challenges are they facing in achieving those goals? By gaining a comprehensive understanding of your customers, you can position your products or services as the solution they’ve been searching for.

Furthermore, it’s crucial to continuously gather feedback from your customers. This can be done through surveys, focus groups, or even one-on-one conversations. By actively listening to your customers, you can identify areas for improvement and make necessary adjustments to your strategy. This not only shows your customers that you value their opinions, but it also allows you to stay ahead of the competition by constantly evolving and adapting to their changing needs.

Understand the state of your GTM

Before you can improve your GTM strategy, you need to understand its current state. This is like embarking on a thrilling detective mission, where you put on your detective hat and dig deep into the intricacies of your sales processes, marketing channels, and customer success initiatives.

Imagine yourself as Sherlock Holmes, carefully analyzing each element of your GTM strategy to uncover hidden insights. Start by conducting a thorough analysis of your sales processes. Examine every step, from lead generation to closing deals, to identify any bottlenecks or inefficiencies that may be hindering your success. Are there any gaps in your sales funnel that need to be addressed? Are your sales cycles too long? Are ACVs too low? Or has the CVR from Opportunity to Closed Won begun to tank this quarter?

Next, turn your attention to your marketing channels. Are you leveraging the right mix of channels to reach your target audience? Are you producing enough opportunities? Have you changed MQL definitions, and now you’re seeing drastic changes on the sales side? Dive into the data and metrics to understand which channels are driving the most qualified leads and which ones may need some optimization. Perhaps there are untapped opportunities in emerging channels that you haven’t explored yet.

Lastly, don’t forget about your customer success initiatives. Are you effectively nurturing and retaining your existing customers? Analyze your customer journey and identify areas to enhance the overall experience. Are there any pain points that need to be addressed? Are there opportunities to upsell or cross-sell to existing customers?

Remember, continuous assessment leads to continuous improvement. By taking the time to understand the current state of your GTM strategy thoroughly, you’ll be able to identify areas for improvement and make informed decisions to drive your business forward. So, put on your detective hat, grab your magnifying glass, and embark on this exciting journey of uncovering the secrets of your GTM strategy!

Implementing a Strategic Revenue Operations Framework

RevOps is all about scalability. As your business grows, your revenue operations processes should grow with it. Build a framework that can adapt to the changing needs of your organization.

Automate repetitive tasks, streamline workflows, and leverage technology to enhance productivity. Doing so will free up time for your team to focus on strategic initiatives that drive revenue growth.

One key aspect of implementing a scalable revenue operations framework is to establish clear and well-defined processes. This involves documenting each step of your revenue operations workflow, from lead generation to closing deals. By having a standardized process in place, you can easily identify bottlenecks and areas for improvement.

If you want examples of how some of the best have done it? Download our free ebook This is what strategic RevOps looks like, and hear stories from Revenue leaders behind companies such like Gong, Hubspot, Nylas, Superside and Drift.

Align Sales, Marketing, and Customer Success Teams

RevOps is the glue that holds different teams together. Collaboration between sales, marketing, and customer success is crucial for efficient revenue operations. Foster a culture of transparency, open communication, and shared goals.

Break those silos and get everyone singing the same revenue-generating hymn!

Imagine a symphony orchestra, where each instrument plays a unique role in creating a harmonious melody. In the world of business, the sales, marketing, and customer success teams are like the different sections of an orchestra. While they may have distinct responsibilities, their collective efforts are what create a beautiful, revenue-generating masterpiece.

Picture this: the sales team, with their persuasive skills and knack for closing deals, acts as the lead violinist, setting the tone and driving the melody forward. Meanwhile, the marketing team, with their creative genius and ability to capture attention, serves as the powerful brass section, adding depth and resonance to the overall composition. And let’s not forget the customer success team, the steady rhythm section, providing the necessary support and ensuring customer satisfaction.

However, for this symphony to truly come to life, it requires more than just individual talent. It demands collaboration, coordination, and a shared vision. This is where RevOps steps in, acting as the conductor, guiding each team member to play their part in perfect harmony.

RevOps is not just about breaking down silos; it’s about building bridges. It encourages sales, marketing, and customer success to work together, sharing insights, strategies, and goals. It fosters a culture of transparency, where information flows freely, empowering each team member to make informed decisions and take ownership of their contributions.

By aligning these teams, you create a powerful force that can overcome any challenge and seize every opportunity. Together, they become an unstoppable ensemble, generating revenue and driving business growth. So, let’s break those silos, harmonize those efforts, and create a symphony of success!

Implement a Centralized Data Platform

In the age of big data, having a centralized data platform is not just important. It’s absolutely crucial. With the exponential growth of data, organizations need a reliable and efficient system to manage and analyze their data effectively.

Imagine a scenario where your organization has data scattered across various systems and databases. Each team has their own data silos, making it difficult to access and analyze information. This fragmented approach not only leads to inefficiencies but also hinders collaboration and decision-making.

By investing in a robust centralized data platform, you can overcome these challenges and unlock the true potential of your data. A centralized data platform acts as a single source of truth, ensuring that all teams have access to accurate and up-to-date information. This eliminates the need for manual data consolidation and reduces the risk of data inconsistencies.

Furthermore, a centralized data platform enables seamless integration with various tools and applications used by different teams. Whether it’s the marketing team analyzing customer behavior, the sales team tracking revenue trends, or RevOps forecasting future growth, everyone can leverage the power of data without any roadblocks.

But what makes a data platform truly robust? It should be scalable, capable of handling large volumes of data without compromising performance. It should provide advanced analytics capabilities, allowing you to derive meaningful insights from your data. Additionally, it should have robust security measures in place to protect sensitive information.

Implementing a centralized data platform may require some initial investment, but the long-term benefits far outweigh the costs. With a happy data platform in place, your Revenue Operations (RevOps) team can work more efficiently, making data-driven decisions that drive growth and success for your organization.

Regularly Review and Optimize Sales Processes

Sales processes are the backbone of your revenue operations. Regularly review and optimize them to ensure efficiency and effectiveness. Identifying bottlenecks, removing unnecessary steps, and empowering your sales team with the right tools and training are crucial steps toward achieving sales excellence.

One important aspect to consider when reviewing your sales processes is the customer journey. Take the time to map out each touchpoint and interaction your customers have with your sales team. By understanding the customer experience, you can identify areas where improvements can be made to enhance customer satisfaction and increase conversion rates.

Another key factor to consider is the alignment between your sales and marketing teams. Effective collaboration between these two departments can significantly impact your sales processes. By aligning your marketing efforts with your sales goals, you can ensure that your sales team receives high-quality leads and has the necessary information to close deals successfully.

Furthermore, it is essential to leverage technology to streamline your sales processes. Implementing a customer relationship management (CRM) system can provide valuable insights into your sales pipeline, allowing you to track leads, manage customer interactions, and measure sales performance. Additionally, automation tools can help eliminate manual tasks, freeing up your sales team to focus on building relationships and closing deals.

Remember, a well-oiled sales machine can help you achieve revenue nirvana. However, it requires continuous evaluation and optimization. By regularly reviewing your sales processes, considering the customer journey, aligning sales and marketing efforts, and leveraging technology, you can create a sales powerhouse that drives sustainable growth and success for your business.

Enhance Data Security and Compliance

With great data comes great responsibility. Protecting customer data and ensuring compliance with data privacy regulations should be a top priority for your RevOps team.

Implementing robust security measures is crucial to safeguarding your customers’ sensitive information. This includes employing encryption techniques to protect data both at rest and in transit, implementing multi-factor authentication to prevent unauthorized access, and regularly updating and patching your systems to address any potential vulnerabilities.

But it doesn’t stop there. Conducting regular audits is essential to ensure that your data security measures are effective and up to date. Regularly reviewing access controls, monitoring system logs, and performing vulnerability assessments will help you identify any potential weaknesses in your security infrastructure and take proactive steps to address them.

In addition to technical measures, educating your team about data privacy best practices is equally important. This includes training employees on how to handle sensitive data, recognizing and reporting potential security incidents, and understanding the importance of data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

By prioritizing data security and compliance, you not only protect your customers’ information but also build trust and credibility. Customers are more likely to do business with companies that demonstrate a commitment to data privacy and take proactive steps to protect their sensitive information. Trust is the foundation of any successful business relationship, and by investing in data security, you are investing in the long-term success of your organization.

Invest in Training and Development

RevOps professionals need to stay ahead of the curve. Invest in training and development programs that equip your team with the latest tools, techniques, and industry knowledge.

Encourage continuous learning, attend webinars, read industry blogs, and foster a culture of curiosity. After all, RevOps is a never-ending journey of growth.

Embrace Continuous Learning and Adaptation

RevOps, like life itself, is a constant learning experience. Embrace change, adopt new methodologies, and be willing to adapt. You never know when the next big thing hits the market or when customer preferences take a sudden turn.

Need a place to start? Make sure to tune in every week to The Revenue Formula Podcast or check out our friends at Winning by Design.

So, put on your learning cap and embark on the never-ending journey of revenue operations!

Invest in RevOps Software

Revenue operations cannot reach their full potential without the right tools. Invest in RevOps software that can help you streamline processes, gain insights, and automate repetitive tasks like data collection.

We’ve created a platform with revenue leaders in mind. Instead of battling multiple CRMs and spreadsheets that break as your engine becomes more complex, get an entire view of your GTM in Growblocks.

Discover how Growblocks can transform your revenue planning, forecasting, and monitoring with our innovative GTM Data modeling.

Say goodbye to guesswork and hello to precision. Learn more about how Growblocks can help you find and fix problems with a single click, set clear expectations for every metric, and stay ahead with real-time performance forecasting.

Take the first step towards a streamlined and proactive RevOps approach with Growblocks.

Sales commissions are a vital aspect of any business, especially in the world of B2B SaaS.

They’re incentives that provide monetary rewards to salespeople based on their individual performance. Simply put, sales commissions are a percentage of the revenue or profit generated from a sale. This system motivates salespeople to work harder and sell more, as their income is directly tied to their performance.

In this article, we’re going to break down everything you need to know about Sales commissions, how to select the right one for your organization, and how to manage them after the fact.

Importance of Sales Commissions

In the B2B SaaS industry, where competition is fierce and margins are tight, sales commissions play a crucial role in attracting and retaining top sales talent. Without the promise of additional income, salespeople may not be as driven to close deals and exceed targets. Sales commissions create a win-win situation, incentivizing salespeople to perform at their best while aligning their goals with the company’s success.

One of the key benefits of sales commissions in the B2B SaaS industry is that they provide a direct link between sales performance and compensation. This means that salespeople have a clear understanding of how their efforts directly impact their earnings. This transparency can foster a sense of ownership and accountability among sales teams, as they are motivated to take ownership of their targets and work towards achieving them.

Moreover, sales commissions in B2B SaaS can also help drive revenue growth for the company. By incentivizing salespeople to sell more, companies can increase their customer base and generate higher revenue. This, in turn, allows the company to invest in product development, marketing, and other areas that contribute to long-term business growth.

Additionally, sales commissions can also serve as a powerful tool for sales team management. By analyzing sales commission data, managers can gain valuable insights into the performance of individual salespeople, identify areas for improvement, and provide targeted coaching and training. This data-driven approach can help optimize sales strategies and ensure that sales teams are equipped with the right skills and resources to succeed.

Types of Sales Commissions in B2B SaaS

When it comes to sales commissions in the B2B SaaS industry, there are several different structures that companies can implement to incentivize their salespeople. Let’s take a closer look at three common types of sales commissions: flat rate commissions, tiered commissions, and revenue-based commissions.

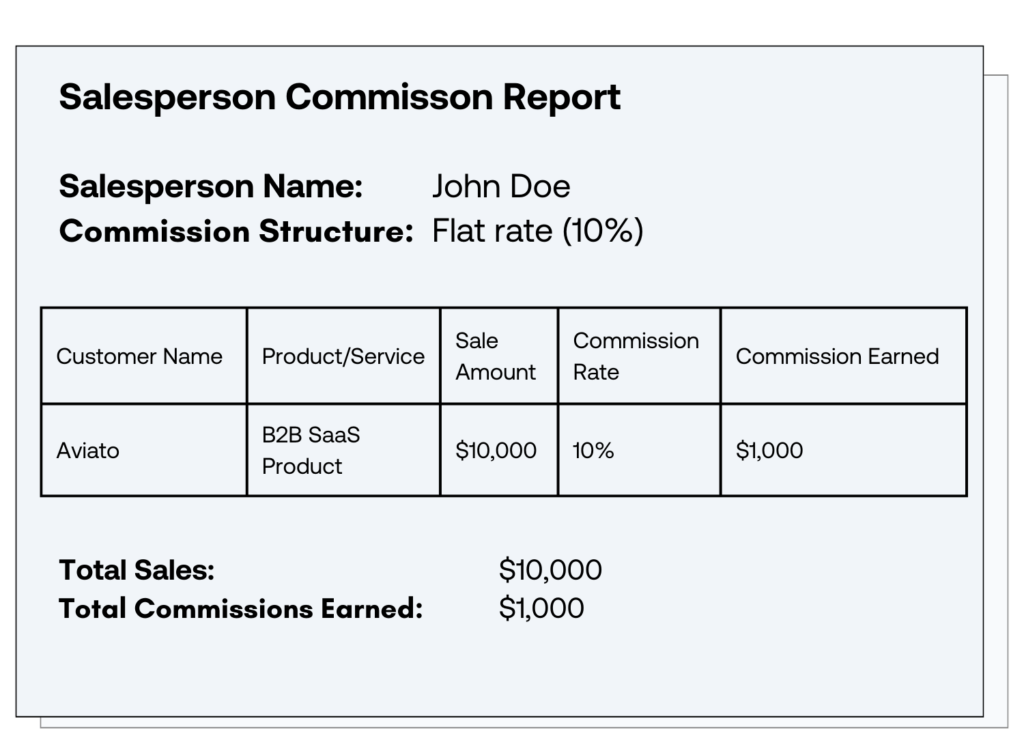

Flat Rate Commissions

Flat rate commissions are one of the most straightforward commission structures. With this method, salespeople earn a fixed percentage of the total sale amount. This type of commission is often used for lower-priced B2B SaaS products or as a base commission for all sales. Flat rate commissions provide clarity and simplicity, allowing salespeople to calculate their income easily.

For example, let’s say a salesperson sells a B2B SaaS product worth $10,000 and the flat rate commission is set at 10%. In this case, the salesperson would earn $1,000 as their commission. This type of commission structure is attractive for salespeople as it ensures a predictable income based on their sales performance.

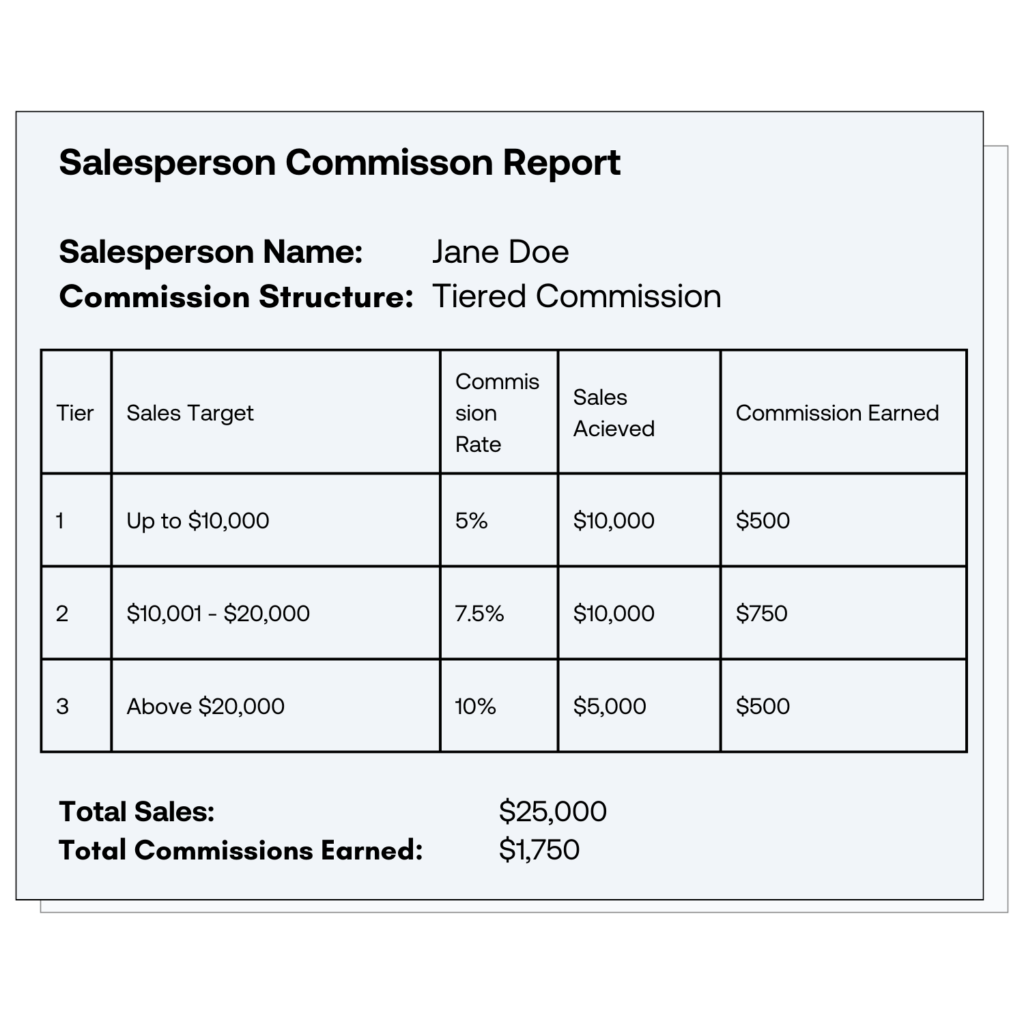

Tiered Commissions

Tiered commissions are a commission structure that rewards salespeople based on different tiers or levels of achievement. As salespeople reach certain milestones or exceed specific targets, they unlock higher commission rates. This approach provides additional motivation for salespeople to strive for higher sales goals and can be an effective way to encourage consistent overperformance.

For instance, a B2B SaaS company may have different tiers of commission rates based on sales targets. If a salesperson achieves a certain level of sales, they may earn a higher commission rate on all sales beyond that threshold. This tiered structure incentivizes salespeople to push themselves and reach higher sales targets, ultimately benefiting both the salesperson and the company.

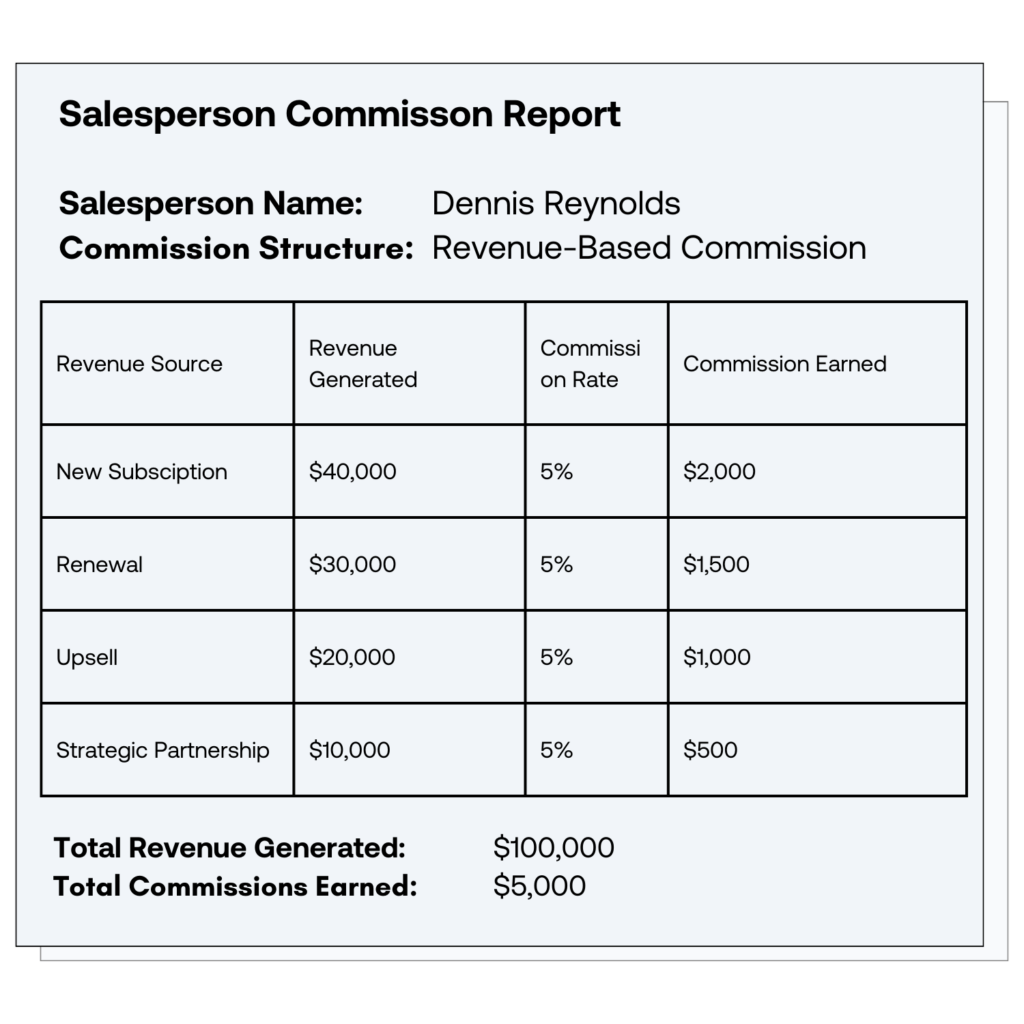

Revenue-Based Commissions

Revenue-based commissions are directly tied to the revenue generated by salespeople. Instead of earning a fixed percentage of the sale amount, salespeople receive a percentage of the revenue they bring in. This type of commission is particularly suitable for B2B SaaS companies with high-profit margins, as it rewards salespeople for driving more significant revenue numbers.

For example, if a salesperson generates $100,000 in revenue for the company and the revenue-based commission rate is set at 5%, they would earn $5,000 as their commission. This commission structure aligns the salesperson’s incentives with the company’s goals of increasing revenue, making it a win-win situation for both parties.

Implementing revenue-based commissions can motivate salespeople to focus on high-value deals and strategic partnerships that have the potential to generate substantial revenue. It encourages salespeople to think strategically and prioritize opportunities that have a higher impact on the company’s overall revenue growth.

Overall, the choice of commission structure in B2B SaaS sales depends on various factors such as the product pricing, sales targets, and profit margins. Companies need to carefully consider these factors and select the commission structure that aligns with their business goals while motivating and rewarding their sales teams.

Setting Up a Sales Commission Structure

Identifying Your Sales Goals

Before designing a sales commission structure, it is vital to have a clear understanding of your sales goals and objectives. Are you aiming for aggressive growth? Or are you focused on retaining existing customers? These goals will shape the foundation of your commission structure and guide your decision-making process.

For example, if your goal is aggressive growth, you may want to consider a commission structure that heavily incentivizes new customer acquisition. On the other hand, if your focus is on retaining existing customers, you may want to design a structure that rewards sales representatives for upselling or cross-selling to current clients.

By aligning your commission structure with your sales goals, you can ensure that your sales team is motivated and driven to achieve the desired outcomes.

Determining Commission Rates

Commission rates should reflect the value of the sale and the effort required to close it. When determining commission rates, it is important to consider various factors such as the complexity of the sale, the sales cycle length, and the level of expertise required to successfully close the deal.

For instance, high-value or complex sales may warrant higher commission rates to compensate sales representatives for their expertise and the additional effort required to close such deals. Conversely, smaller deals may have lower commission rates, as they may require less time and effort.

Striking the right balance between motivating your sales team and maintaining profitability is crucial. It is recommended to regularly review and adjust commission rates based on market conditions and the overall performance of your sales team. This ensures that your commission structure remains competitive and continues to incentivize your sales representatives effectively.

Establishing Payment Terms

Clear and transparent payment terms are essential for a smooth commission process. It is important to establish when commissions will be paid out to your sales team. This could be on a monthly, quarterly, or upon deal closure basis, depending on your company’s financial structure and sales cycle.

Communicating these payment terms to your sales team is equally important. By clearly outlining when and how commissions will be paid, you can avoid misunderstandings or frustrations related to commission payments. This transparency helps build trust and ensures that your sales representatives have a clear understanding of the commission process.

Additionally, consider implementing a system that provides regular updates on commission earnings. This allows your sales team to track their progress and provides them with a sense of motivation and accountability.

Remember, a well-designed commission structure, supported by clear payment terms, can significantly contribute to the success of your sales team and the overall growth of your business.

Managing Sales Commissions

Tracking Sales Performance

Monitoring sales performance is critical to measuring the effectiveness of your commission structure and identifying areas for improvement. Implement a robust sales tracking system that allows you to record and analyze key performance indicators (KPIs), such as conversion rates, average deal size, and sales cycle length. With accurate data, you can make data-driven decisions to optimize your commission structure and drive better results.

Handling Commission Disputes

Occasionally, commission disputes may arise due to misunderstandings or disagreements between salespeople and management. Proactively establish a clear process for resolving disputes, ensuring fairness and transparency. Promptly address any concerns and provide a platform for open communication to maintain a healthy and trusting relationship with your sales team.

Reviewing and Adjusting Commission Structures

A commission structure is not set in stone. It requires regular evaluation and adjustment to remain relevant and effective. Keep a close eye on market trends, competitor practices, and changes within your industry. Review and adapt your commission structure as necessary to keep it aligned with your business objectives and to motivate your sales team to exceed expectations.

4 Mistakes to avoid

As this article has laid out, commissions in B2B SaaS can be a tricky task. It requires careful consideration to ensure that you reward your sales team appropriately while also aligning their incentives with the company’s goals. However, there are common mistakes that many organizations make when it comes to setting sales commissions. Here are four mistakes you should avoid to ensure a fair and effective commission structure.

1. Clawbacks

At its core, clawbacks are used to protect the company. Let’s say you have a newly signed customer, but for whatever reason (whether it’s a legitimate cancellation or not), they don’t end up paying you. The commission, in this case, is “clawed back” from the rep’s next paycheck. This ensures that salespeople are accountable for the long-term success of the deals they close.

The argument is that without clawbacks, salespeople may be incentivized to close deals that are short-term wins but ultimately harmful to the company in the long run.

But the reality is that companies need to carry the risk in this situation. There can be hundreds of reasons why a deal doesn’t stick. Putting it all on your AE is not productive to that relationship.

Now, that’s not to say there are no “bad apples” in your sales team. For example, they may offer deep discounts or make unrealistic promises to win a deal, only for the customer to churn shortly after. In this case, it’s a situation of re-training or letting that rep go.

But installing a clawback system does nothing but create a destructive and demoralizing rule for everyone.

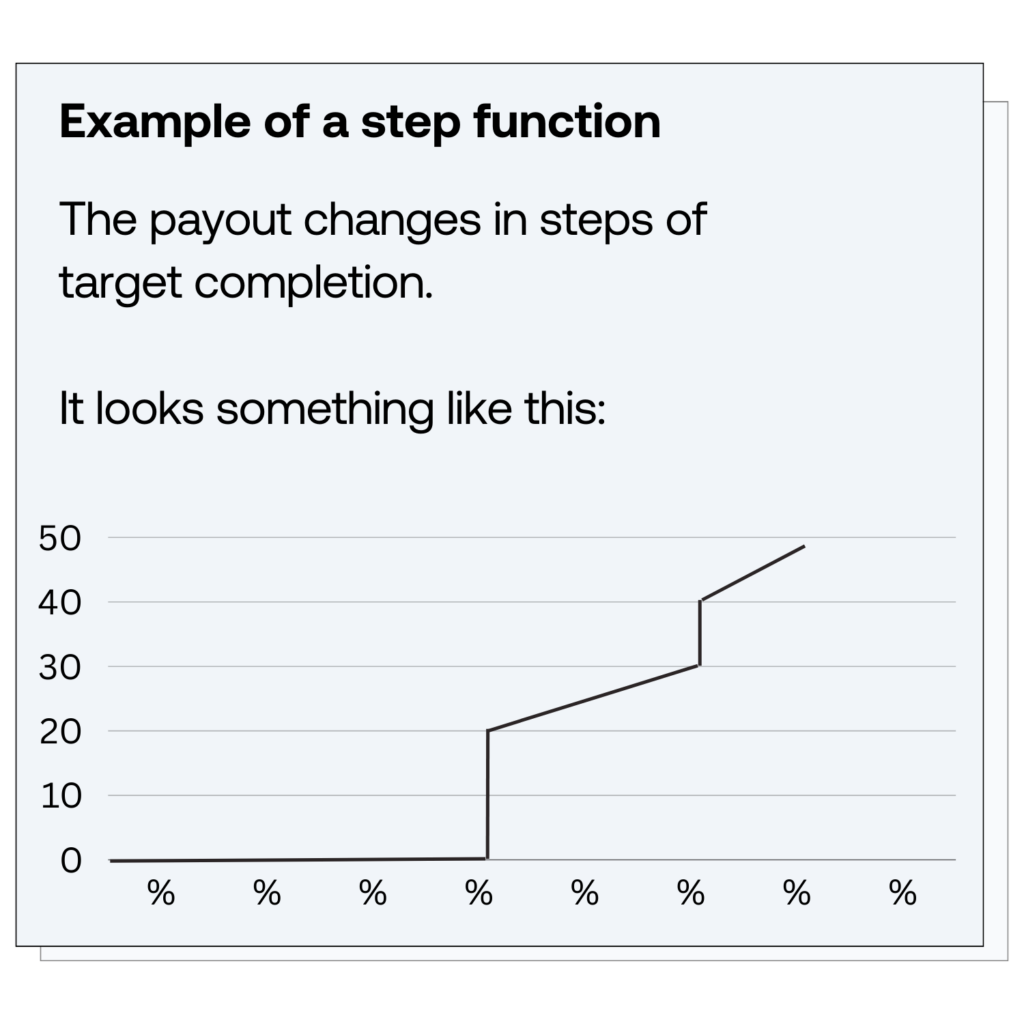

2. Step functions

Another mistake to avoid is using step functions in your commission structure. Step functions occur when the commission rate jumps significantly at certain revenue thresholds. While this may seem like a good way to incentivize salespeople to hit higher targets, it can actually discourage steady progress.

Salespeople who are close to reaching a higher threshold may feel demotivated if they know that the additional effort required to hit the next step will result in only a marginal increase in commission. On the other hand, salespeople who have already surpassed the first few thresholds may coast instead of pushing themselves even further. A more linear commission structure that rewards incremental progress can help maintain motivation and drive consistent results.

Let’s consider an example to understand the impact of step functions in a commission structure. Imagine a sales team where the commission rate increases from 5% to 10% when they reach $100,000 in sales. This sudden jump in commission rate can create a sense of frustration for salespeople who are close to reaching the threshold. They may feel that their efforts are not being adequately rewarded, leading to a decrease in motivation.

Furthermore, step functions can also lead to complacency among salespeople who have already surpassed the initial thresholds. Once they have reached the higher commission rate, they may become less driven to push themselves further. This can result in a plateau in sales performance, as salespeople settle for the comfortable level of commission they are already earning.

On the other hand, a more linear commission structure that rewards incremental progress can have a positive impact on sales team motivation and performance. By offering smaller, but consistent, increases in commission rates for reaching specific sales targets, salespeople are motivated to continuously strive for improvement. This creates a sense of momentum and encourages salespeople to consistently push themselves to achieve higher sales figures.

So while step functions may initially seem like an effective way to incentivize salespeople, they can actually hinder steady progress and demotivate individuals. Implementing a more linear commission structure that rewards incremental progress can help maintain motivation, drive consistent results, and foster a culture of continuous improvement within your sales team.

3. Capped comps

Setting capped commissions is another mistake to avoid. Capped commissions limit the maximum amount that a salesperson can earn, regardless of their performance. While this may seem like a way to control costs, it can have unintended consequences.

Salespeople who consistently exceed their targets may feel frustrated and unmotivated if there is a cap on their earnings. They may also be more likely to look for opportunities elsewhere where their efforts will be properly rewarded. By removing caps on commissions, you create a more attractive compensation package that encourages top performers to stay and continue driving growth for your company.

Imagine a scenario where a salesperson, let’s call her Sarah, has consistently been the top performer in your company. She consistently exceeds her targets, brings in lucrative deals, and is a driving force behind the company’s success. However, due to the capped commission structure in place, Sarah’s earnings are limited, regardless of her exceptional performance.

As a result, Sarah begins to feel undervalued and unappreciated. She starts questioning her dedication to the company and wonders if her efforts are truly recognized. This frustration starts to affect her motivation and enthusiasm for her work. Sarah, being the talented individual she is, starts exploring other job opportunities where her exceptional performance will be rewarded without any limitations.

Now, consider the impact of losing a top performer like Sarah. Not only will you lose her expertise and ability to bring in valuable business, but it will also send a message to the rest of your sales team. They may start questioning the fairness of the capped commission structure and whether their hard work will ever be fully recognized and rewarded.

By removing caps on commissions, you not only retain top performers like Sarah but also create a culture of recognition and reward for exceptional performance. Salespeople will feel motivated to push their limits, knowing that their efforts will be duly acknowledged and compensated. This, in turn, drives a healthy competition within the sales team, leading to increased productivity and overall company growth.

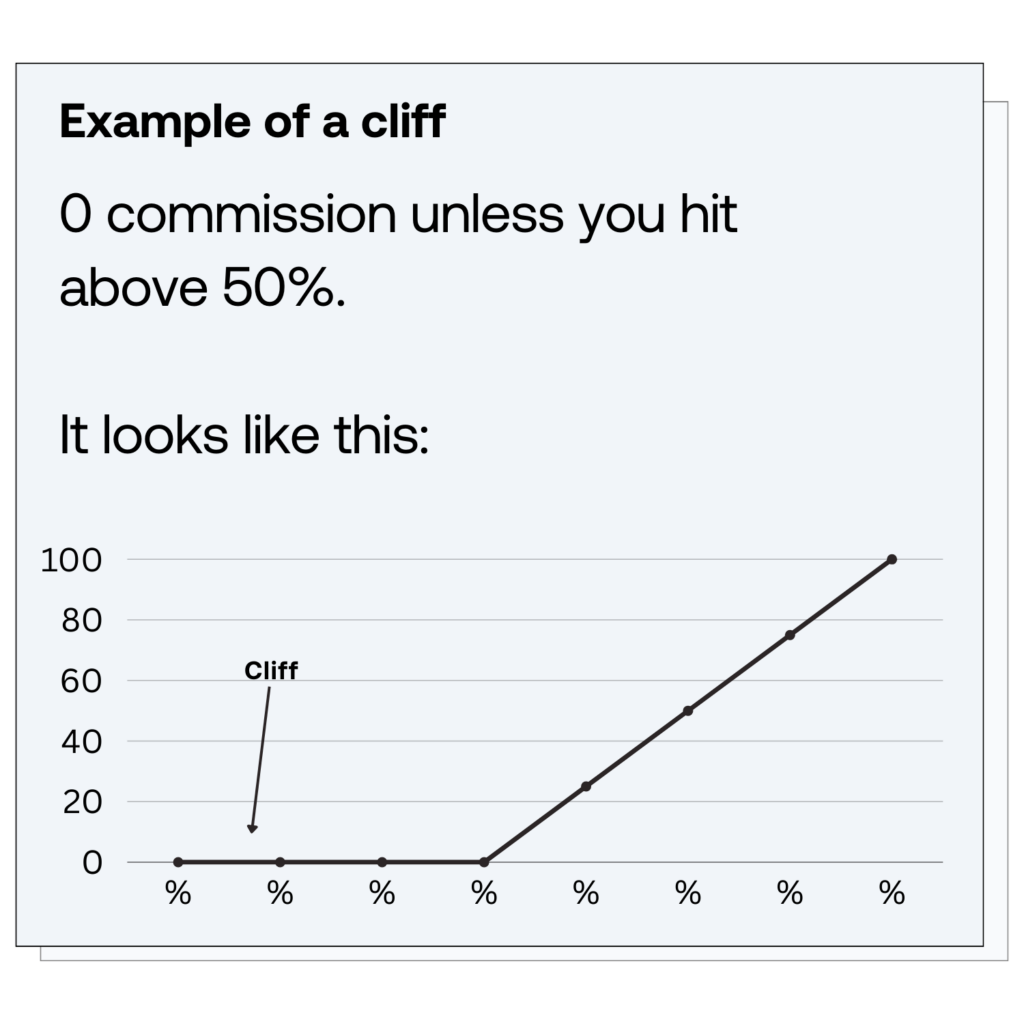

4. Cliffs

Lastly, be cautious about using cliffs in your commission structure. A cliff occurs when a salesperson does not earn any commission until they reach a specific threshold. While cliffs can be used to incentivize salespeople to achieve a minimum level of performance, they can also create a sense of unfairness.

A salesperson who is just below the cliff but has put in substantial effort may feel discouraged and demotivated knowing that they are not earning any commission yet. Gradual ramp-ups or tiered structures can be alternatives to cliffs, providing incremental rewards for improving performance, even if the salesperson hasn’t crossed a specific threshold.

However, it’s important to dive deeper into the potential consequences of using cliffs in your commission structure. Let’s consider a scenario where a salesperson is just a few dollars short of reaching the threshold. They have been working tirelessly, making countless calls, attending meetings, and putting in extra hours to close deals. Despite their efforts, they are still not eligible for any commission. This can lead to frustration and a feeling of being undervalued.

Furthermore, the negative impact of cliffs can extend beyond the individual salesperson. Picture a team of salespeople working together towards a common goal. They are collaborating, sharing insights, and supporting each other. However, when cliffs are introduced, the dynamic changes. Suddenly, the focus shifts from teamwork to individual competition. Salespeople may become reluctant to share their knowledge or help their colleagues, as they fear that it could potentially benefit someone else in reaching the commission threshold before them.

Now that you’ve prepared your Sales commissions, are you ready to elevate your Sales motion?

Take the insights and strategies you’ve discovered to the next level with Growblocks. Our platform helps you manage and forecast your entire Go-to-Market (not just Sales), and find any problem in your engine so you can focus on execution.

Book a demo and start transforming your revenue strategy today.

We’re going on a journey together. On this journey, you’ll find that the way you’ve been taught to conduct capacity planning is fundamentally broken.

By the end of the journey (ie. this article), you’ll know exactly how to take capacity planning to the next level – ensuring capacity is not the reason you miss target.

What is a capacity plan

Imagine you were planning to sail around the world.

You’d ensure that you’d have all the right equipment, food and a clear route. As you set sail, a crew member gets sick. Trying to ensure a safe voyage, you realize that you haven’t brought enough crew members.

This is what it looks like on the salesfloor: You always hire AEs too late. An AE resigns and you didn’t plan for it. In both cases, you lost closing capacity – otherwise referred to as quota on the street.

The capacity plan exists to ensure you have enough salesreps to close the needed pipeline.

Sales capacity planning is a critical aspect of any organization’s growth and revenue generation strategy. It involves forecasting and managing the number of sales representatives required to meet revenue targets.

What it does not factor in, but should – is filling that capacity. We’ll cover that as well, but let’s not get ahead of ourselves.

The basic capacity plan for sales

Let’s create a basic sales capacity plan for a B2B SaaS company.

Before we jump in, let’s define some of the inputs you’ll need in order to model this out:

- AEs (Account Executives): Sales reps responsible for closing deals

- Ramp: The time it takes for a new sales rep to reach full productivity

- Segment reps: Sales reps who focus on specific markets or verticals

- Quota capacity: The amount of quota (sales) an AE can carry

These are commonly used to create capacity plans, attrition and similar is where it’ll get advanced (we’ll get to that later).

Let’s dive in.

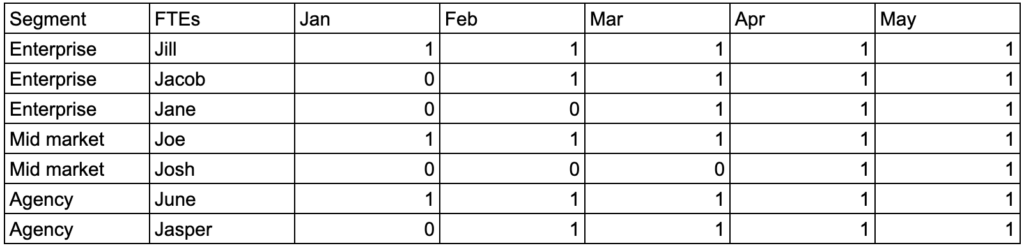

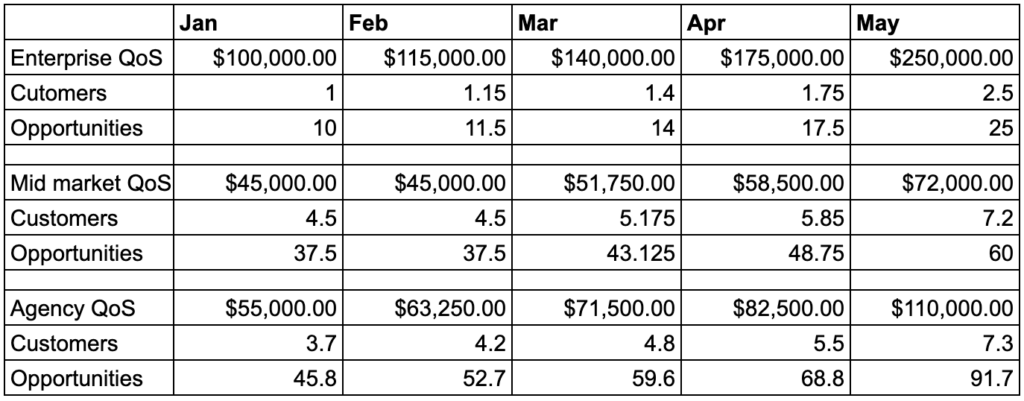

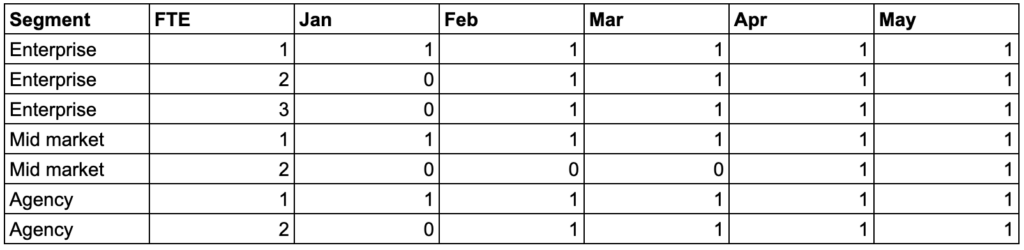

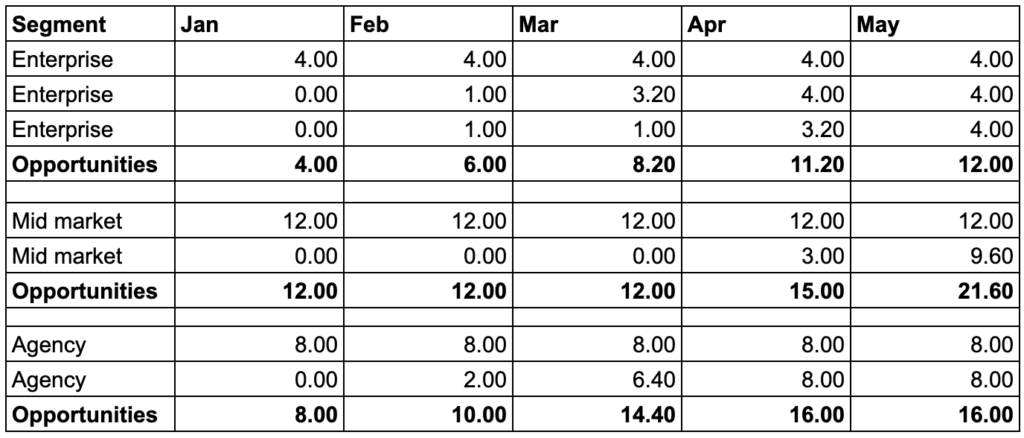

First you need to create an overview of the team, including current AEs and future hires. To keep it simple, I’ve used a short timeframe, but I hope the overview gives you an idea of where I’m going with it.

Once you know exactly how many hands you have on the keyboards and when, we can move to the next step: quota capacity.

You need to define how much quota different reps can carry. You want to create a segmentation that makes sense to your business. In this case, I’ve used enterprise, midmarket and agencies. You could split it into seniority, geographies and so on. If your team is small (<10 reps), simple is better.

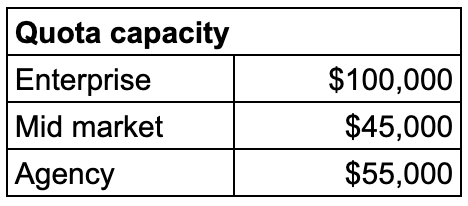

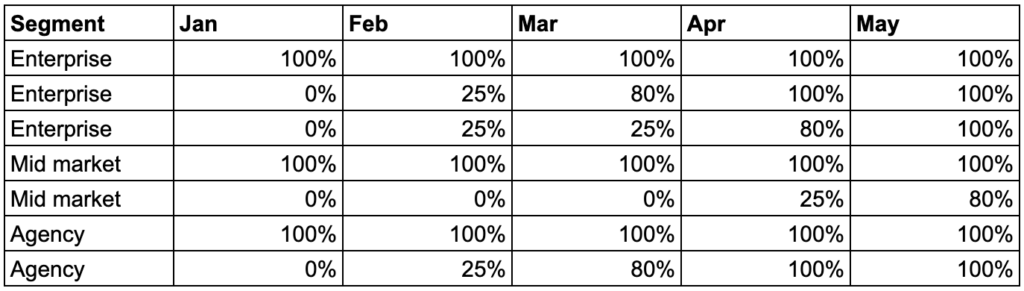

But here’s the thing. Just because we hire an AE to start in February, that doesn’t mean they can carry 100% of their quota. That would be kinda unfair.

So allow me to use a golf term – handicap. An AE who’s ramping, needs a handicap that changes over time. If you’re a pro, you should run an analysis of past hires and how fast they ramped to determine what that % looks like over time.

Here’s an example of how I’ve defined ramp times of the different reps we’ll be hiring:

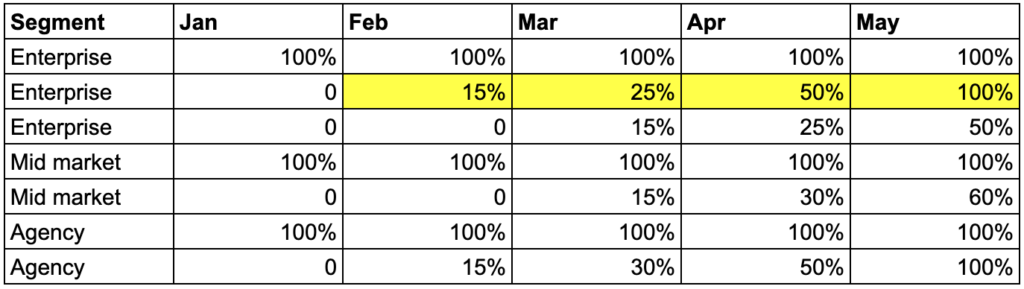

Once you have these squared away, you can quite easily calculate the total quota on the street as it evolves over time.

And that’s a very basic approach to sales capacity planning. At this point you’re able to adjust the quota depending on what the financial plan requires.

And right here is where most people make a mistake. They stop. You won’t, will you?.

If we return to the example of the voyage. Imagine our goal is to catch fish along the way to feed us. We’ve made a beautiful capacity plan that tells us we need 5 people to catch fish per day.

Unfortunately, we’ve only brought one fishing rod. So the crew of five, who are getting a commission on fish caught, now gets to fight over who gets to use the rod. Yikes.

Thankfully, there’s an advanced approach to capacity planning, one that considers the demand.

The advanced capacity plan

The advanced approach takes a different view. We’ve effectively created demand for opportunities with our model.

If we don’t give the reps in this case any opportunities, there’s no way they’ll hit target (AEs should close deals, not book meetings).

The advanced approach considers how we effectively fill the capacity over time – meaning, how many customers do we need to sign, and to do that, how many opportunities do we need.

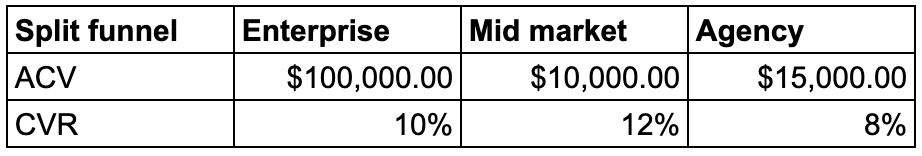

First there’s a few additional metrics you’ll need to create an advanced capacity plan:

- Closed/won CVR: The conversion rate from opportunity to closed/won

- ACV: Average contract value

Let’s start by figuring out how many opportunities we need at any given time to fill capacity.

If our target for January is $200,000, and we have an ACV of $10,000, we’ll need $200,000 / $10,000 = 20 customers.

[ Quota on the Street / Average contract value = # of customers needed ]

As you’ll have varying ACVs and CVRs by segment, you’ll need to split those – in our case into enterprise, mid market and agencies.

We’ll use those split metrics to calculate the amount of customers we need for each segment. And while we’re at it, we might as well calculate the amount of opportunities we’ll need to get those customers. The formula to get the number of opportunities is:

[ Closed-won customers / closed-won conversion rate = number of opportunities ]

Once you reach this level, you’ll be able to calculate the “Meetings-on-the-Street”, or better yet – your meeting quota. That is, ensuring you have the capacity to book the meetings needed. And that’s exactly what SDRs do, book meetings.

And to keep our world simple, let’s just say our business only has one motion: outbound.

This is the approach we’ll take

- What does the hiring plan look like across segments

- Average monthly meeting production per SDR

- Ramp up time

- Meeting quota production

To keep it simple, I’ve assumed the average monthly meeting production per SDR is as follows:

- Enterprise: 4

- Mid market: 12

- Agency: 8

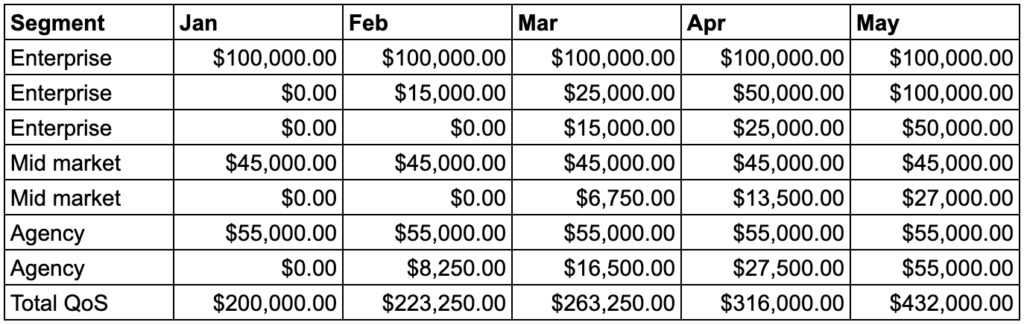

Just like with the AEs, first step is to define the what the hiring plan looks like – who will you have at any given point in time:

From here, we again need to define ramp time for the SDRs we’re hiring.

There’s no exact science, you can run an analysis, but most likely your SDR managers will be able to provide a good bar for you to work with. Otherwise use insight partners benchmarks for reference. Here’s the ramp used:

Now comes the fun part. With these points we can calculate how many opportunities we’ll be able to create using ramp – essentially using the %-ramp against average monthly meeting production we get:

While this is overly simplified (you’d probably have more SDRs than AEs), this is extremely helpful as you’ll clearly identify any gaps relating to filling AEs capacity on opportunities.

And… Congratulations, you’ve made it much farther than your peers if your capacity plan splits the funnel and considers opportunity supply.

But, there’s actually a whole other level you can take it to. Let’s call it epic.

Epic sales capacity planning

Okay, so at this point, it really becomes mad-scientist math.

But it’ll be helpful if you’re past $25M ARR and are rapidly expanding an outbound motion.

There’s a couple of things the model doesn’t consider yet:

- Time: How long does it take to create and close an opportunity?

- Attrition: How many AEs and SDRs will move away from their role, when?

- Segments: Do different industries and sizes change ACVs, velocity etc?

- Sources: Inbound, outbound and partner deals all behave very differently

We definitely want to include these – so we ensure that we’re staffing properly and producing opportunities at the right time to hit the revenue target. Moreover, different segments and sources behave differently in the funnel – that has to be considered as well.

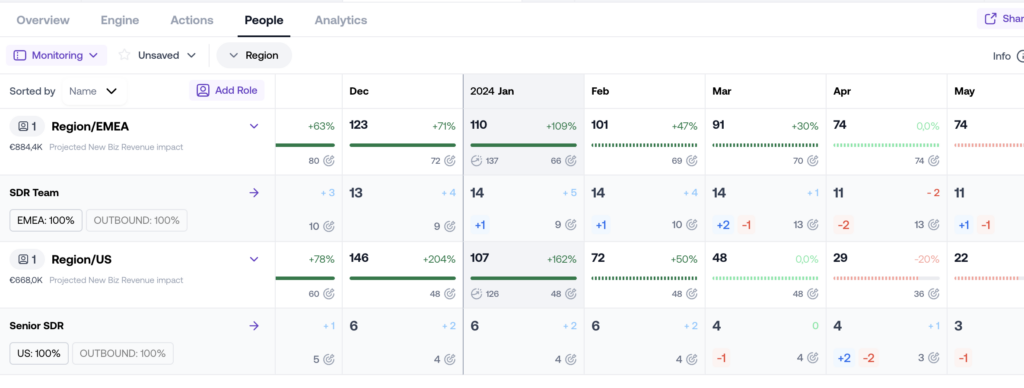

Rather than creating a messy sheet, I’ll use Growblocks. If you’re an excel expert, you can create this as well in your model.

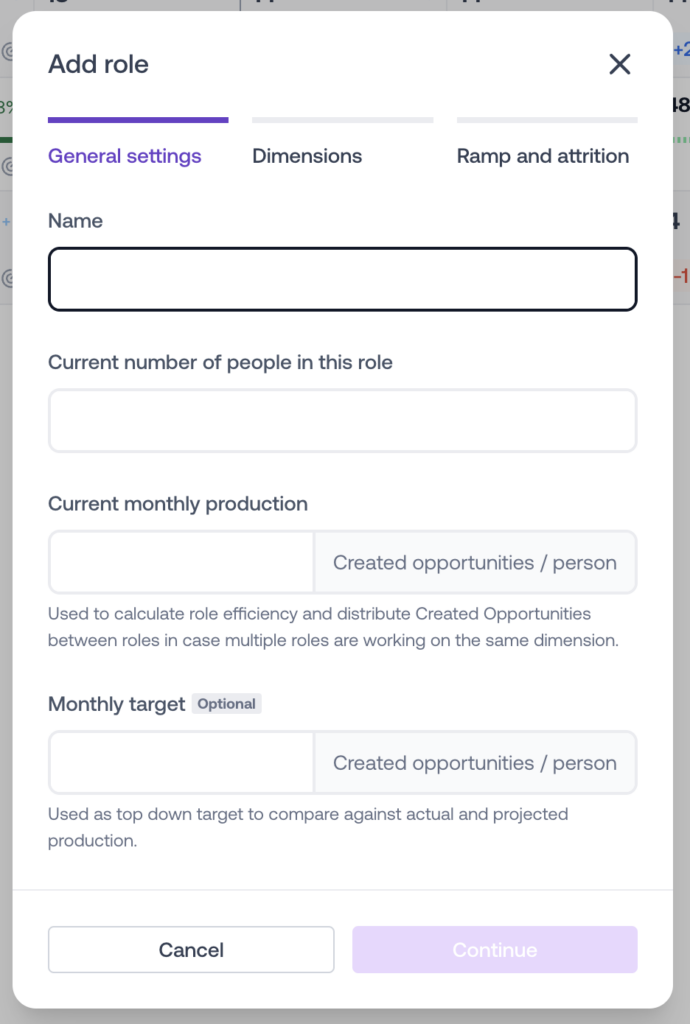

First off, creating a basic plan of SDRs is pretty quick, it took me less than a minute to add all SDRs in this example.

Attrition is pretty flexible to manage by setting a global attrition rate, or manually overriding the numbers.

From here it’ll add the opportunity production based on my inputs: average productivity per SDR and ramp up time.