The ultimate guide to Sales commissions in B2B SaaS

Sales commissions are a vital aspect of any business, especially in the world of B2B SaaS.

They’re incentives that provide monetary rewards to salespeople based on their individual performance. Simply put, sales commissions are a percentage of the revenue or profit generated from a sale. This system motivates salespeople to work harder and sell more, as their income is directly tied to their performance.

In this article, we’re going to break down everything you need to know about Sales commissions, how to select the right one for your organization, and how to manage them after the fact.

Importance of Sales Commissions

In the B2B SaaS industry, where competition is fierce and margins are tight, sales commissions play a crucial role in attracting and retaining top sales talent. Without the promise of additional income, salespeople may not be as driven to close deals and exceed targets. Sales commissions create a win-win situation, incentivizing salespeople to perform at their best while aligning their goals with the company’s success.

One of the key benefits of sales commissions in the B2B SaaS industry is that they provide a direct link between sales performance and compensation. This means that salespeople have a clear understanding of how their efforts directly impact their earnings. This transparency can foster a sense of ownership and accountability among sales teams, as they are motivated to take ownership of their targets and work towards achieving them.

Moreover, sales commissions in B2B SaaS can also help drive revenue growth for the company. By incentivizing salespeople to sell more, companies can increase their customer base and generate higher revenue. This, in turn, allows the company to invest in product development, marketing, and other areas that contribute to long-term business growth.

Additionally, sales commissions can also serve as a powerful tool for sales team management. By analyzing sales commission data, managers can gain valuable insights into the performance of individual salespeople, identify areas for improvement, and provide targeted coaching and training. This data-driven approach can help optimize sales strategies and ensure that sales teams are equipped with the right skills and resources to succeed.

Types of Sales Commissions in B2B SaaS

When it comes to sales commissions in the B2B SaaS industry, there are several different structures that companies can implement to incentivize their salespeople. Let’s take a closer look at three common types of sales commissions: flat rate commissions, tiered commissions, and revenue-based commissions.

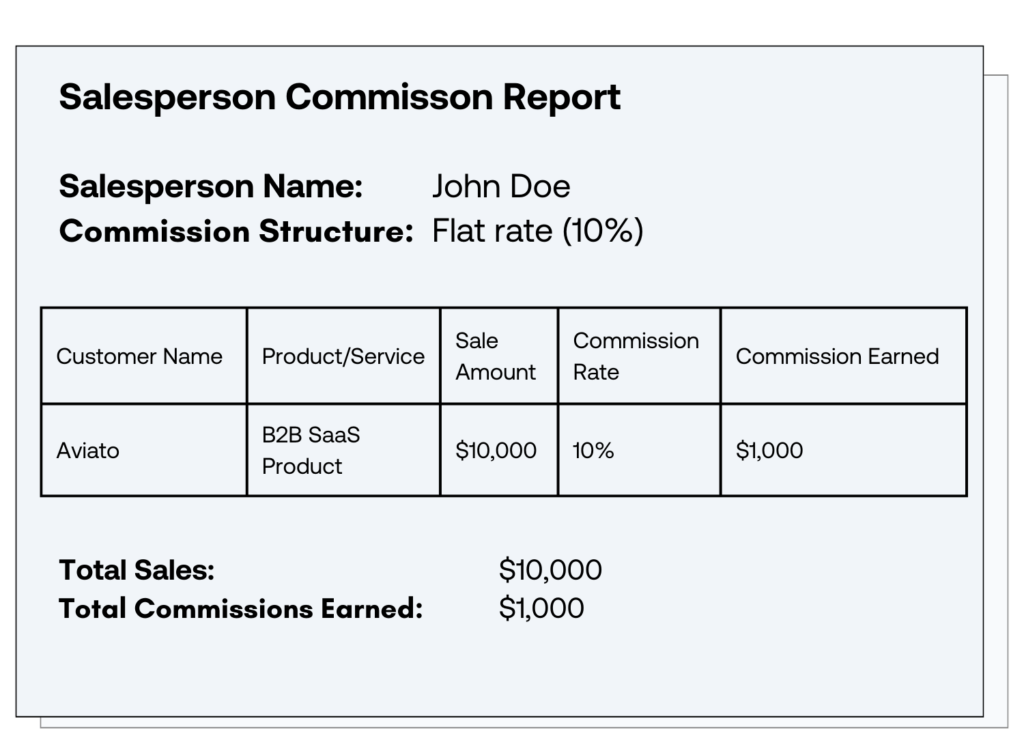

Flat Rate Commissions

Flat rate commissions are one of the most straightforward commission structures. With this method, salespeople earn a fixed percentage of the total sale amount. This type of commission is often used for lower-priced B2B SaaS products or as a base commission for all sales. Flat rate commissions provide clarity and simplicity, allowing salespeople to calculate their income easily.

For example, let’s say a salesperson sells a B2B SaaS product worth $10,000 and the flat rate commission is set at 10%. In this case, the salesperson would earn $1,000 as their commission. This type of commission structure is attractive for salespeople as it ensures a predictable income based on their sales performance.

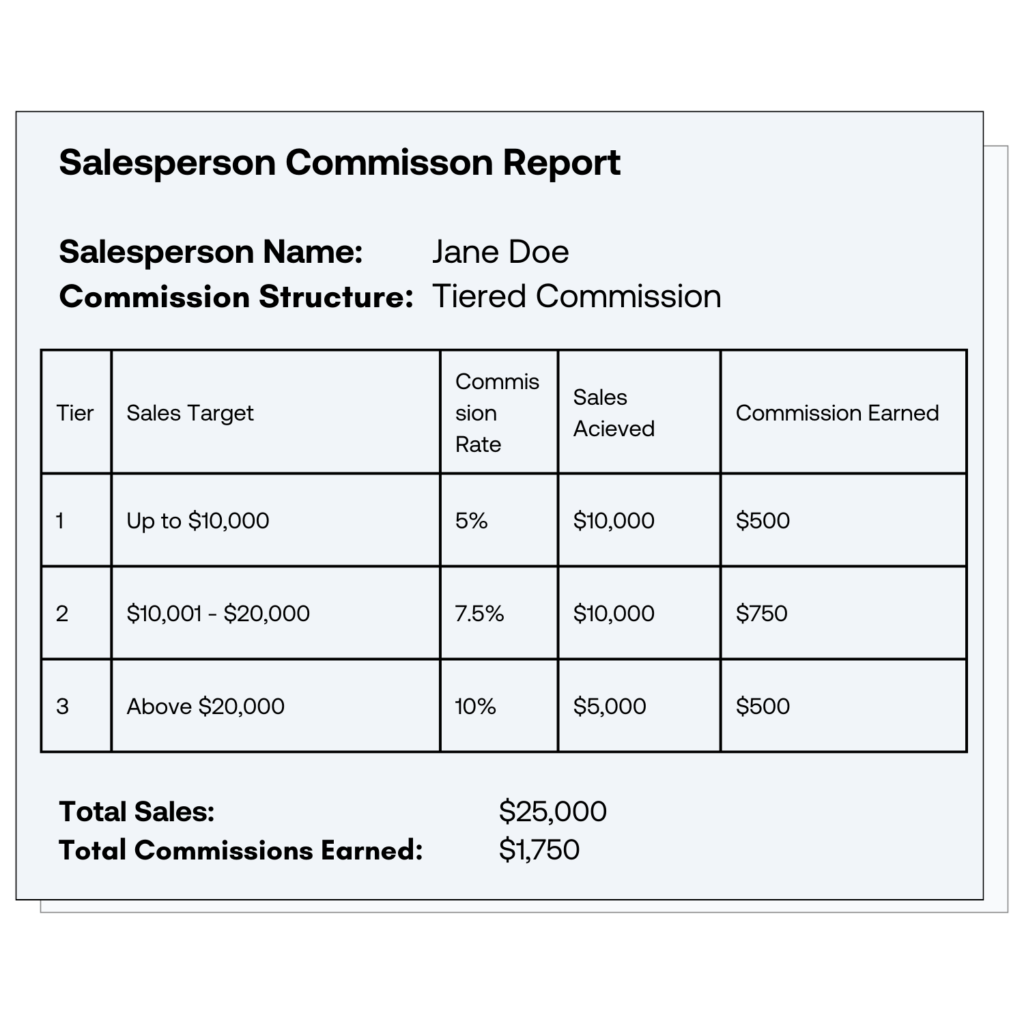

Tiered Commissions

Tiered commissions are a commission structure that rewards salespeople based on different tiers or levels of achievement. As salespeople reach certain milestones or exceed specific targets, they unlock higher commission rates. This approach provides additional motivation for salespeople to strive for higher sales goals and can be an effective way to encourage consistent overperformance.

For instance, a B2B SaaS company may have different tiers of commission rates based on sales targets. If a salesperson achieves a certain level of sales, they may earn a higher commission rate on all sales beyond that threshold. This tiered structure incentivizes salespeople to push themselves and reach higher sales targets, ultimately benefiting both the salesperson and the company.

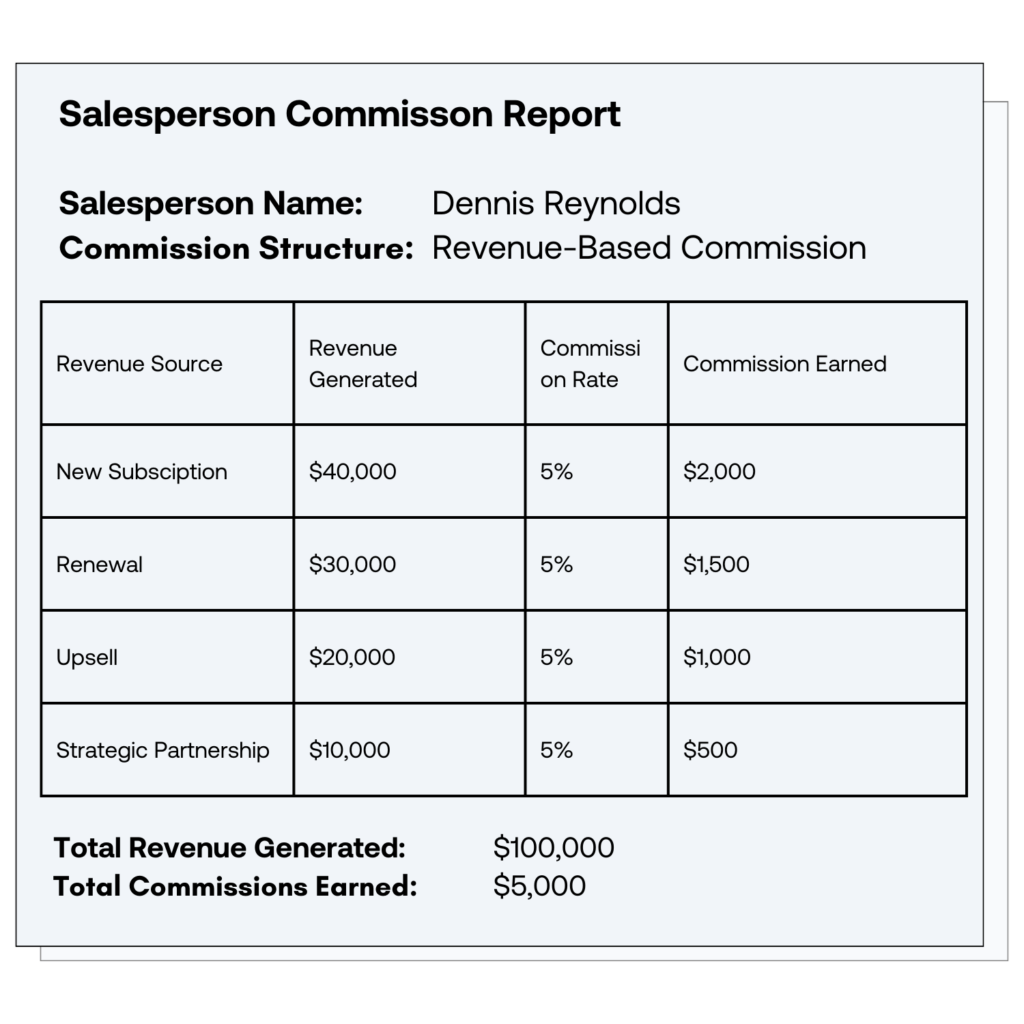

Revenue-Based Commissions

Revenue-based commissions are directly tied to the revenue generated by salespeople. Instead of earning a fixed percentage of the sale amount, salespeople receive a percentage of the revenue they bring in. This type of commission is particularly suitable for B2B SaaS companies with high-profit margins, as it rewards salespeople for driving more significant revenue numbers.

For example, if a salesperson generates $100,000 in revenue for the company and the revenue-based commission rate is set at 5%, they would earn $5,000 as their commission. This commission structure aligns the salesperson’s incentives with the company’s goals of increasing revenue, making it a win-win situation for both parties.

Implementing revenue-based commissions can motivate salespeople to focus on high-value deals and strategic partnerships that have the potential to generate substantial revenue. It encourages salespeople to think strategically and prioritize opportunities that have a higher impact on the company’s overall revenue growth.

Overall, the choice of commission structure in B2B SaaS sales depends on various factors such as the product pricing, sales targets, and profit margins. Companies need to carefully consider these factors and select the commission structure that aligns with their business goals while motivating and rewarding their sales teams.

Setting Up a Sales Commission Structure

Identifying Your Sales Goals

Before designing a sales commission structure, it is vital to have a clear understanding of your sales goals and objectives. Are you aiming for aggressive growth? Or are you focused on retaining existing customers? These goals will shape the foundation of your commission structure and guide your decision-making process.

For example, if your goal is aggressive growth, you may want to consider a commission structure that heavily incentivizes new customer acquisition. On the other hand, if your focus is on retaining existing customers, you may want to design a structure that rewards sales representatives for upselling or cross-selling to current clients.

By aligning your commission structure with your sales goals, you can ensure that your sales team is motivated and driven to achieve the desired outcomes.

Determining Commission Rates

Commission rates should reflect the value of the sale and the effort required to close it. When determining commission rates, it is important to consider various factors such as the complexity of the sale, the sales cycle length, and the level of expertise required to successfully close the deal.

For instance, high-value or complex sales may warrant higher commission rates to compensate sales representatives for their expertise and the additional effort required to close such deals. Conversely, smaller deals may have lower commission rates, as they may require less time and effort.

Striking the right balance between motivating your sales team and maintaining profitability is crucial. It is recommended to regularly review and adjust commission rates based on market conditions and the overall performance of your sales team. This ensures that your commission structure remains competitive and continues to incentivize your sales representatives effectively.

Establishing Payment Terms

Clear and transparent payment terms are essential for a smooth commission process. It is important to establish when commissions will be paid out to your sales team. This could be on a monthly, quarterly, or upon deal closure basis, depending on your company’s financial structure and sales cycle.

Communicating these payment terms to your sales team is equally important. By clearly outlining when and how commissions will be paid, you can avoid misunderstandings or frustrations related to commission payments. This transparency helps build trust and ensures that your sales representatives have a clear understanding of the commission process.

Additionally, consider implementing a system that provides regular updates on commission earnings. This allows your sales team to track their progress and provides them with a sense of motivation and accountability.

Remember, a well-designed commission structure, supported by clear payment terms, can significantly contribute to the success of your sales team and the overall growth of your business.

Managing Sales Commissions

Tracking Sales Performance

Monitoring sales performance is critical to measuring the effectiveness of your commission structure and identifying areas for improvement. Implement a robust sales tracking system that allows you to record and analyze key performance indicators (KPIs), such as conversion rates, average deal size, and sales cycle length. With accurate data, you can make data-driven decisions to optimize your commission structure and drive better results.

Handling Commission Disputes

Occasionally, commission disputes may arise due to misunderstandings or disagreements between salespeople and management. Proactively establish a clear process for resolving disputes, ensuring fairness and transparency. Promptly address any concerns and provide a platform for open communication to maintain a healthy and trusting relationship with your sales team.

Reviewing and Adjusting Commission Structures

A commission structure is not set in stone. It requires regular evaluation and adjustment to remain relevant and effective. Keep a close eye on market trends, competitor practices, and changes within your industry. Review and adapt your commission structure as necessary to keep it aligned with your business objectives and to motivate your sales team to exceed expectations.

4 Mistakes to avoid

As this article has laid out, commissions in B2B SaaS can be a tricky task. It requires careful consideration to ensure that you reward your sales team appropriately while also aligning their incentives with the company’s goals. However, there are common mistakes that many organizations make when it comes to setting sales commissions. Here are four mistakes you should avoid to ensure a fair and effective commission structure.

1. Clawbacks

At its core, clawbacks are used to protect the company. Let’s say you have a newly signed customer, but for whatever reason (whether it’s a legitimate cancellation or not), they don’t end up paying you. The commission, in this case, is “clawed back” from the rep’s next paycheck. This ensures that salespeople are accountable for the long-term success of the deals they close.

The argument is that without clawbacks, salespeople may be incentivized to close deals that are short-term wins but ultimately harmful to the company in the long run.

But the reality is that companies need to carry the risk in this situation. There can be hundreds of reasons why a deal doesn’t stick. Putting it all on your AE is not productive to that relationship.

Now, that’s not to say there are no “bad apples” in your sales team. For example, they may offer deep discounts or make unrealistic promises to win a deal, only for the customer to churn shortly after. In this case, it’s a situation of re-training or letting that rep go.

But installing a clawback system does nothing but create a destructive and demoralizing rule for everyone.

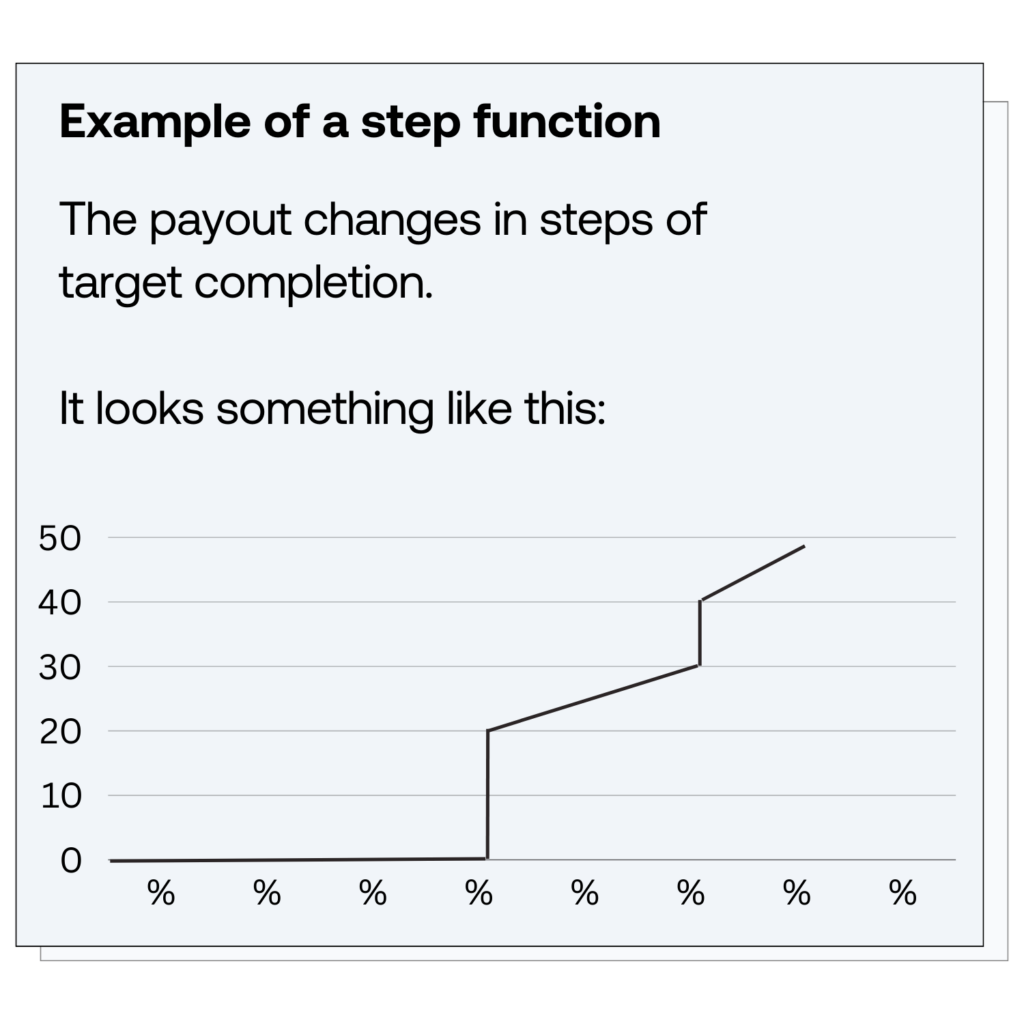

2. Step functions

Another mistake to avoid is using step functions in your commission structure. Step functions occur when the commission rate jumps significantly at certain revenue thresholds. While this may seem like a good way to incentivize salespeople to hit higher targets, it can actually discourage steady progress.

Salespeople who are close to reaching a higher threshold may feel demotivated if they know that the additional effort required to hit the next step will result in only a marginal increase in commission. On the other hand, salespeople who have already surpassed the first few thresholds may coast instead of pushing themselves even further. A more linear commission structure that rewards incremental progress can help maintain motivation and drive consistent results.

Let’s consider an example to understand the impact of step functions in a commission structure. Imagine a sales team where the commission rate increases from 5% to 10% when they reach $100,000 in sales. This sudden jump in commission rate can create a sense of frustration for salespeople who are close to reaching the threshold. They may feel that their efforts are not being adequately rewarded, leading to a decrease in motivation.

Furthermore, step functions can also lead to complacency among salespeople who have already surpassed the initial thresholds. Once they have reached the higher commission rate, they may become less driven to push themselves further. This can result in a plateau in sales performance, as salespeople settle for the comfortable level of commission they are already earning.

On the other hand, a more linear commission structure that rewards incremental progress can have a positive impact on sales team motivation and performance. By offering smaller, but consistent, increases in commission rates for reaching specific sales targets, salespeople are motivated to continuously strive for improvement. This creates a sense of momentum and encourages salespeople to consistently push themselves to achieve higher sales figures.

So while step functions may initially seem like an effective way to incentivize salespeople, they can actually hinder steady progress and demotivate individuals. Implementing a more linear commission structure that rewards incremental progress can help maintain motivation, drive consistent results, and foster a culture of continuous improvement within your sales team.

3. Capped comps

Setting capped commissions is another mistake to avoid. Capped commissions limit the maximum amount that a salesperson can earn, regardless of their performance. While this may seem like a way to control costs, it can have unintended consequences.

Salespeople who consistently exceed their targets may feel frustrated and unmotivated if there is a cap on their earnings. They may also be more likely to look for opportunities elsewhere where their efforts will be properly rewarded. By removing caps on commissions, you create a more attractive compensation package that encourages top performers to stay and continue driving growth for your company.

Imagine a scenario where a salesperson, let’s call her Sarah, has consistently been the top performer in your company. She consistently exceeds her targets, brings in lucrative deals, and is a driving force behind the company’s success. However, due to the capped commission structure in place, Sarah’s earnings are limited, regardless of her exceptional performance.

As a result, Sarah begins to feel undervalued and unappreciated. She starts questioning her dedication to the company and wonders if her efforts are truly recognized. This frustration starts to affect her motivation and enthusiasm for her work. Sarah, being the talented individual she is, starts exploring other job opportunities where her exceptional performance will be rewarded without any limitations.

Now, consider the impact of losing a top performer like Sarah. Not only will you lose her expertise and ability to bring in valuable business, but it will also send a message to the rest of your sales team. They may start questioning the fairness of the capped commission structure and whether their hard work will ever be fully recognized and rewarded.

By removing caps on commissions, you not only retain top performers like Sarah but also create a culture of recognition and reward for exceptional performance. Salespeople will feel motivated to push their limits, knowing that their efforts will be duly acknowledged and compensated. This, in turn, drives a healthy competition within the sales team, leading to increased productivity and overall company growth.

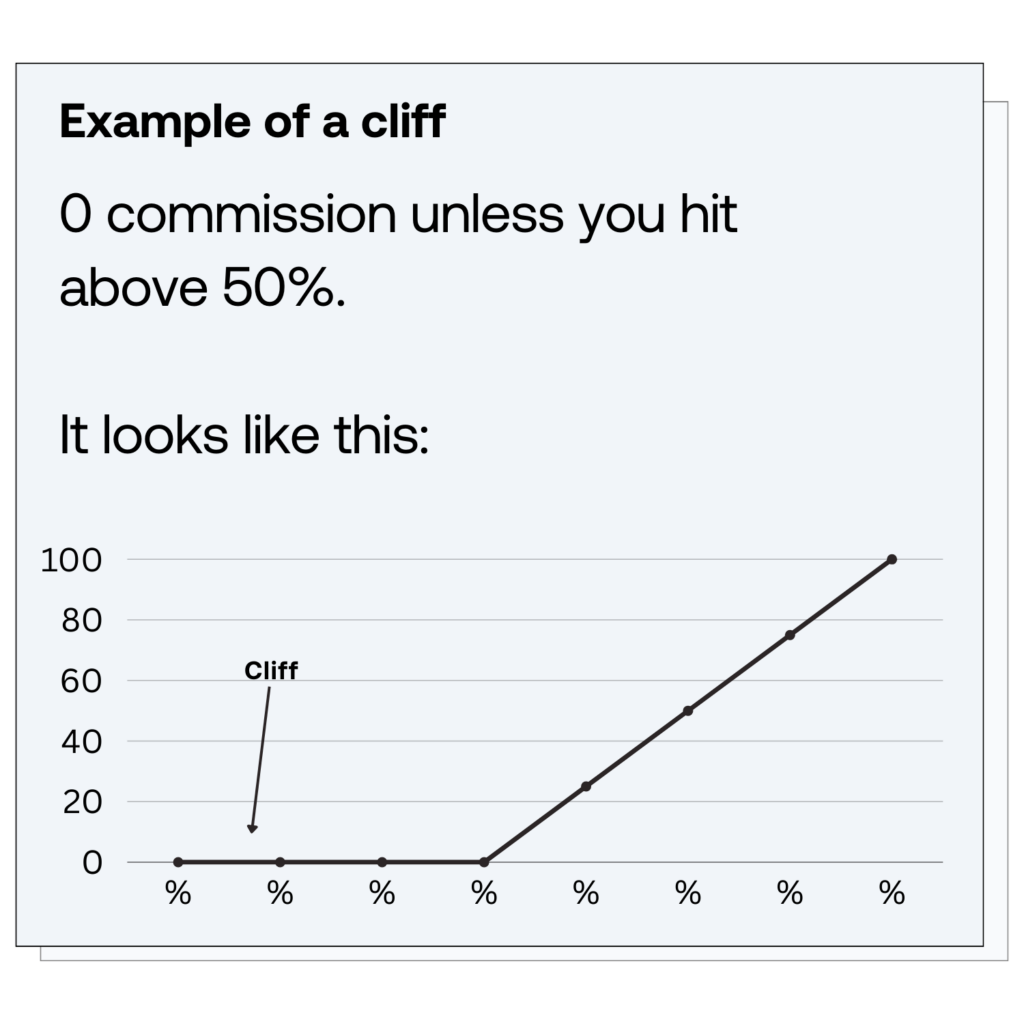

4. Cliffs

Lastly, be cautious about using cliffs in your commission structure. A cliff occurs when a salesperson does not earn any commission until they reach a specific threshold. While cliffs can be used to incentivize salespeople to achieve a minimum level of performance, they can also create a sense of unfairness.

A salesperson who is just below the cliff but has put in substantial effort may feel discouraged and demotivated knowing that they are not earning any commission yet. Gradual ramp-ups or tiered structures can be alternatives to cliffs, providing incremental rewards for improving performance, even if the salesperson hasn’t crossed a specific threshold.

However, it’s important to dive deeper into the potential consequences of using cliffs in your commission structure. Let’s consider a scenario where a salesperson is just a few dollars short of reaching the threshold. They have been working tirelessly, making countless calls, attending meetings, and putting in extra hours to close deals. Despite their efforts, they are still not eligible for any commission. This can lead to frustration and a feeling of being undervalued.

Furthermore, the negative impact of cliffs can extend beyond the individual salesperson. Picture a team of salespeople working together towards a common goal. They are collaborating, sharing insights, and supporting each other. However, when cliffs are introduced, the dynamic changes. Suddenly, the focus shifts from teamwork to individual competition. Salespeople may become reluctant to share their knowledge or help their colleagues, as they fear that it could potentially benefit someone else in reaching the commission threshold before them.

Now that you’ve prepared your Sales commissions, are you ready to elevate your Sales motion?

Take the insights and strategies you’ve discovered to the next level with Growblocks. Our platform helps you manage and forecast your entire Go-to-Market (not just Sales), and find any problem in your engine so you can focus on execution.

Book a demo and start transforming your revenue strategy today.