The advanced guide to capacity planning for SaaS

We’re going on a journey together. On this journey, you’ll find that the way you’ve been taught to conduct capacity planning is fundamentally broken.

By the end of the journey (ie. this article), you’ll know exactly how to take capacity planning to the next level – ensuring capacity is not the reason you miss target.

What is a capacity plan

Imagine you were planning to sail around the world.

You’d ensure that you’d have all the right equipment, food and a clear route. As you set sail, a crew member gets sick. Trying to ensure a safe voyage, you realize that you haven’t brought enough crew members.

This is what it looks like on the salesfloor: You always hire AEs too late. An AE resigns and you didn’t plan for it. In both cases, you lost closing capacity – otherwise referred to as quota on the street.

The capacity plan exists to ensure you have enough salesreps to close the needed pipeline.

Sales capacity planning is a critical aspect of any organization’s growth and revenue generation strategy. It involves forecasting and managing the number of sales representatives required to meet revenue targets.

What it does not factor in, but should – is filling that capacity. We’ll cover that as well, but let’s not get ahead of ourselves.

The basic capacity plan for sales

Let’s create a basic sales capacity plan for a B2B SaaS company.

Before we jump in, let’s define some of the inputs you’ll need in order to model this out:

- AEs (Account Executives): Sales reps responsible for closing deals

- Ramp: The time it takes for a new sales rep to reach full productivity

- Segment reps: Sales reps who focus on specific markets or verticals

- Quota capacity: The amount of quota (sales) an AE can carry

These are commonly used to create capacity plans, attrition and similar is where it’ll get advanced (we’ll get to that later).

Let’s dive in.

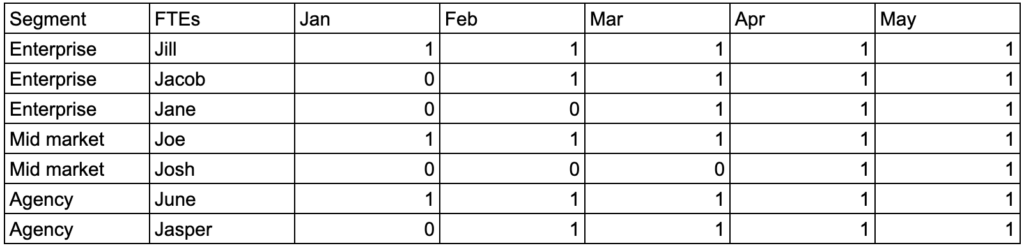

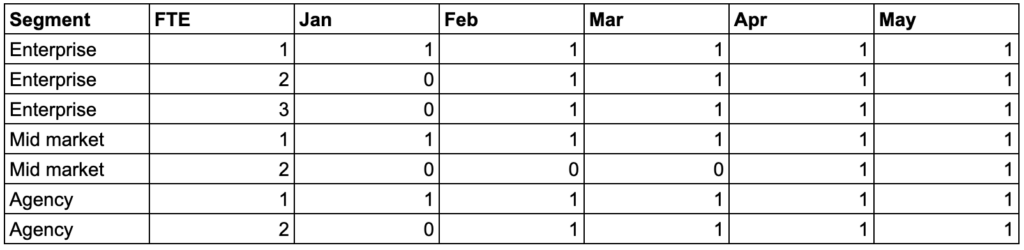

First you need to create an overview of the team, including current AEs and future hires. To keep it simple, I’ve used a short timeframe, but I hope the overview gives you an idea of where I’m going with it.

Once you know exactly how many hands you have on the keyboards and when, we can move to the next step: quota capacity.

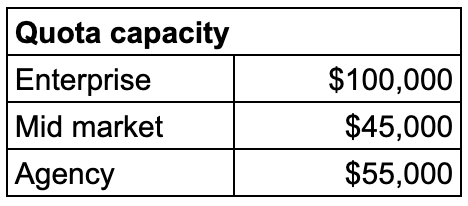

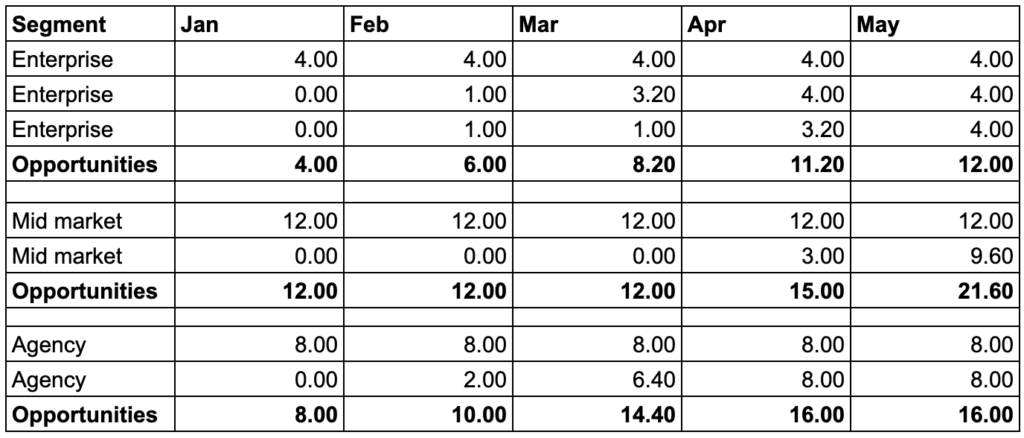

You need to define how much quota different reps can carry. You want to create a segmentation that makes sense to your business. In this case, I’ve used enterprise, midmarket and agencies. You could split it into seniority, geographies and so on. If your team is small (<10 reps), simple is better.

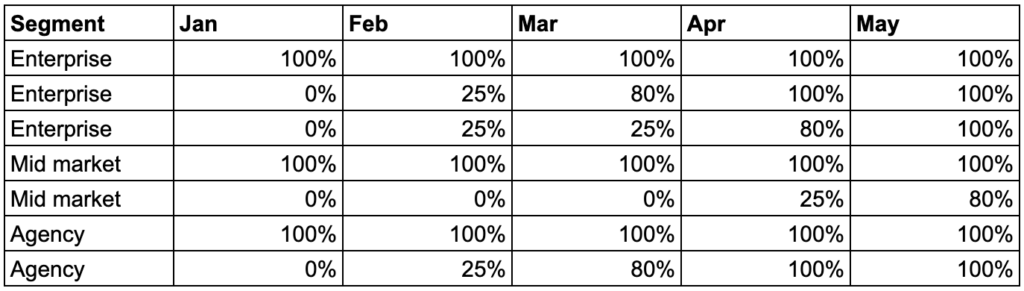

But here’s the thing. Just because we hire an AE to start in February, that doesn’t mean they can carry 100% of their quota. That would be kinda unfair.

So allow me to use a golf term – handicap. An AE who’s ramping, needs a handicap that changes over time. If you’re a pro, you should run an analysis of past hires and how fast they ramped to determine what that % looks like over time.

Here’s an example of how I’ve defined ramp times of the different reps we’ll be hiring:

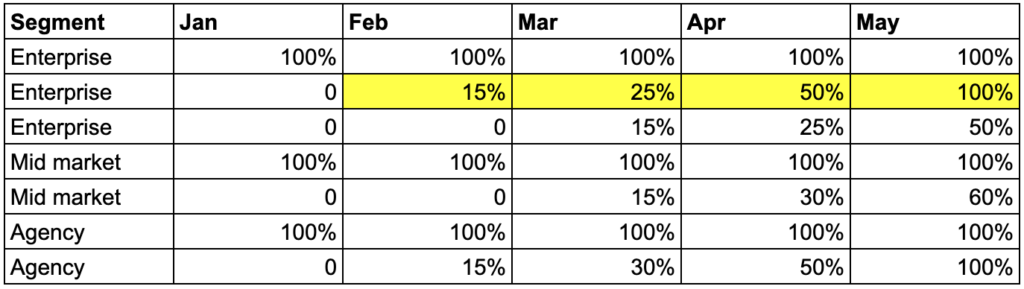

Once you have these squared away, you can quite easily calculate the total quota on the street as it evolves over time.

And that’s a very basic approach to sales capacity planning. At this point you’re able to adjust the quota depending on what the financial plan requires.

And right here is where most people make a mistake. They stop. You won’t, will you?.

If we return to the example of the voyage. Imagine our goal is to catch fish along the way to feed us. We’ve made a beautiful capacity plan that tells us we need 5 people to catch fish per day.

Unfortunately, we’ve only brought one fishing rod. So the crew of five, who are getting a commission on fish caught, now gets to fight over who gets to use the rod. Yikes.

Thankfully, there’s an advanced approach to capacity planning, one that considers the demand.

The advanced capacity plan

The advanced approach takes a different view. We’ve effectively created demand for opportunities with our model.

If we don’t give the reps in this case any opportunities, there’s no way they’ll hit target (AEs should close deals, not book meetings).

The advanced approach considers how we effectively fill the capacity over time – meaning, how many customers do we need to sign, and to do that, how many opportunities do we need.

First there’s a few additional metrics you’ll need to create an advanced capacity plan:

- Closed/won CVR: The conversion rate from opportunity to closed/won

- ACV: Average contract value

Let’s start by figuring out how many opportunities we need at any given time to fill capacity.

If our target for January is $200,000, and we have an ACV of $10,000, we’ll need $200,000 / $10,000 = 20 customers.

[ Quota on the Street / Average contract value = # of customers needed ]

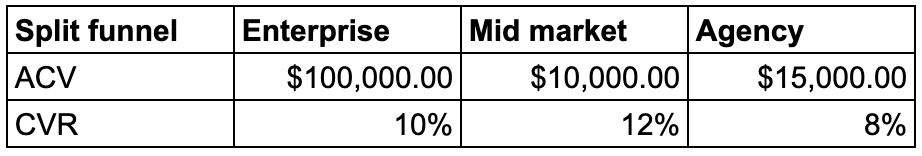

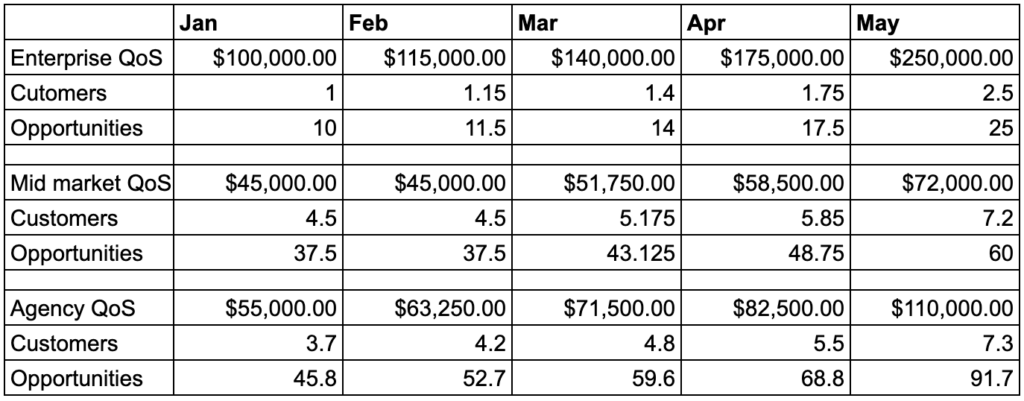

As you’ll have varying ACVs and CVRs by segment, you’ll need to split those – in our case into enterprise, mid market and agencies.

We’ll use those split metrics to calculate the amount of customers we need for each segment. And while we’re at it, we might as well calculate the amount of opportunities we’ll need to get those customers. The formula to get the number of opportunities is:

[ Closed-won customers / closed-won conversion rate = number of opportunities ]

Once you reach this level, you’ll be able to calculate the “Meetings-on-the-Street”, or better yet – your meeting quota. That is, ensuring you have the capacity to book the meetings needed. And that’s exactly what SDRs do, book meetings.

And to keep our world simple, let’s just say our business only has one motion: outbound.

This is the approach we’ll take

- What does the hiring plan look like across segments

- Average monthly meeting production per SDR

- Ramp up time

- Meeting quota production

To keep it simple, I’ve assumed the average monthly meeting production per SDR is as follows:

- Enterprise: 4

- Mid market: 12

- Agency: 8

Just like with the AEs, first step is to define the what the hiring plan looks like – who will you have at any given point in time:

From here, we again need to define ramp time for the SDRs we’re hiring.

There’s no exact science, you can run an analysis, but most likely your SDR managers will be able to provide a good bar for you to work with. Otherwise use insight partners benchmarks for reference. Here’s the ramp used:

Now comes the fun part. With these points we can calculate how many opportunities we’ll be able to create using ramp – essentially using the %-ramp against average monthly meeting production we get:

While this is overly simplified (you’d probably have more SDRs than AEs), this is extremely helpful as you’ll clearly identify any gaps relating to filling AEs capacity on opportunities.

And… Congratulations, you’ve made it much farther than your peers if your capacity plan splits the funnel and considers opportunity supply.

But, there’s actually a whole other level you can take it to. Let’s call it epic.

Epic sales capacity planning

Okay, so at this point, it really becomes mad-scientist math.

But it’ll be helpful if you’re past $25M ARR and are rapidly expanding an outbound motion.

There’s a couple of things the model doesn’t consider yet:

- Time: How long does it take to create and close an opportunity?

- Attrition: How many AEs and SDRs will move away from their role, when?

- Segments: Do different industries and sizes change ACVs, velocity etc?

- Sources: Inbound, outbound and partner deals all behave very differently

We definitely want to include these – so we ensure that we’re staffing properly and producing opportunities at the right time to hit the revenue target. Moreover, different segments and sources behave differently in the funnel – that has to be considered as well.

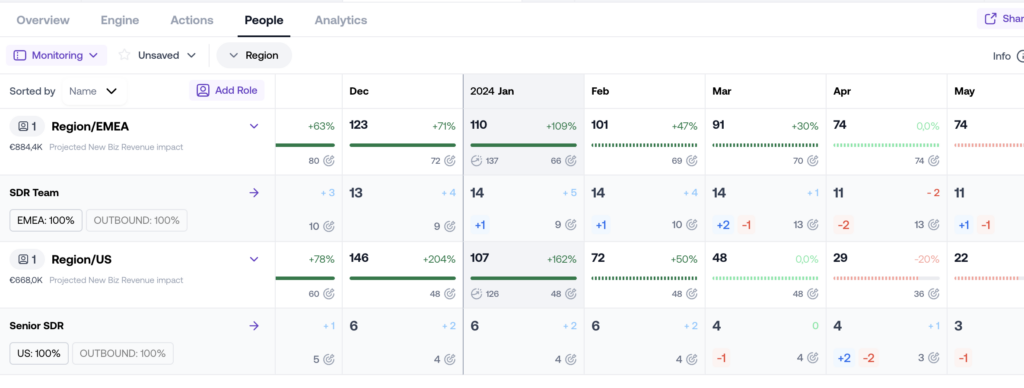

Rather than creating a messy sheet, I’ll use Growblocks. If you’re an excel expert, you can create this as well in your model.

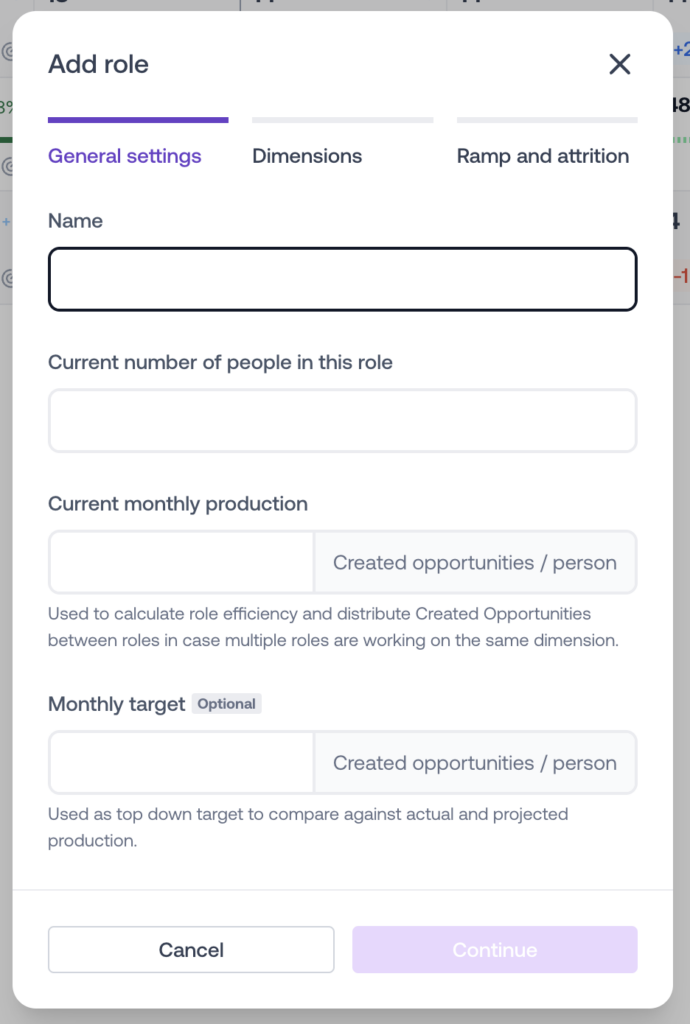

First off, creating a basic plan of SDRs is pretty quick, it took me less than a minute to add all SDRs in this example.

Attrition is pretty flexible to manage by setting a global attrition rate, or manually overriding the numbers.

From here it’ll add the opportunity production based on my inputs: average productivity per SDR and ramp up time.

But most importantly, it’s able to factor in the sales cycle length when looking at the revenue it’s forecasting.

All the logic is built in – and yes you can build this in a spreadsheet which is a great start. But what won’t be possible is to forecast total performance across channels.

This is just one of many inputs we use to determine what the forecast looks like.